Sybil Attack Impact Calculator

Enter parameters and click Calculate to see estimated impact.

This calculator estimates the potential financial impact of a Sybil attack based on:

- Fake Identities: Number of fraudulent wallets or nodes created

- Value per Identity: Estimated value of each fake identity (e.g., voting power or transaction fees)

- Network Control: Percentage of network consensus or governance the attacker can manipulate

- Governance Token Value: Total value of tokens that could be influenced by the attack

The result shows potential financial losses and governance disruption caused by the attack.

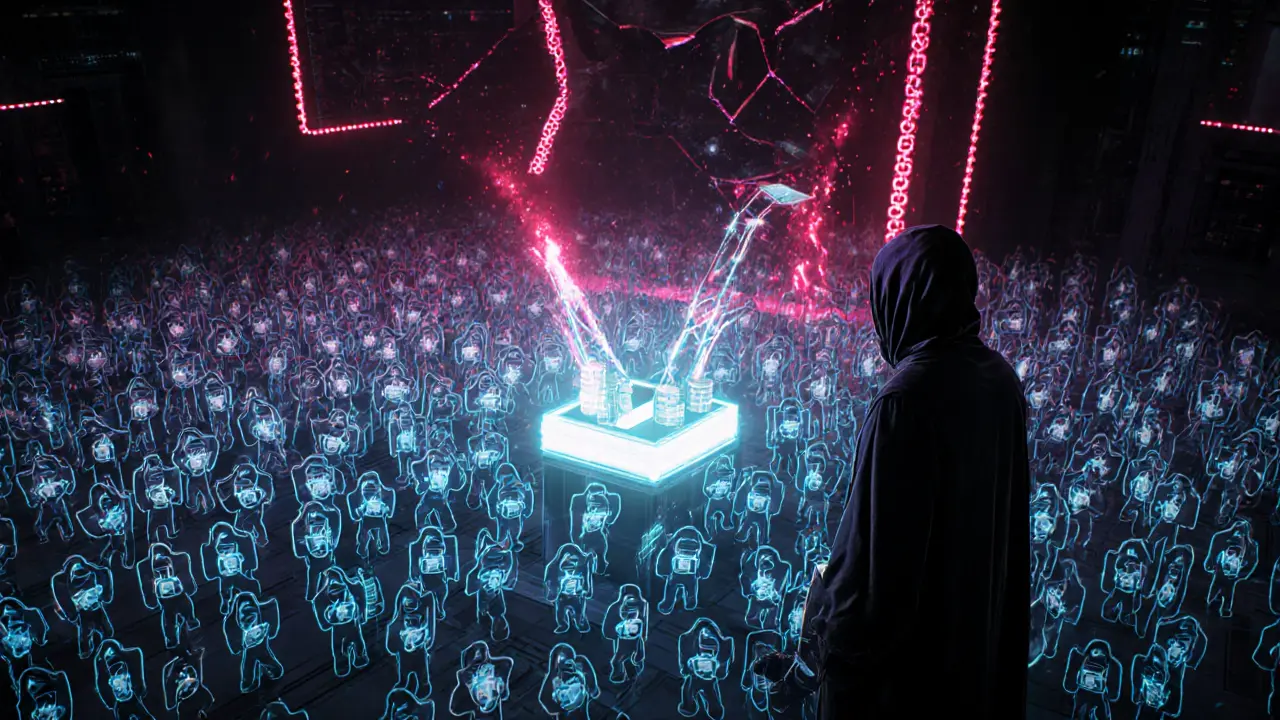

In the world of blockchain, Sybil attacks are a type of security breach where a single adversary creates many fake identities to overpower honest participants. The goal is simple: flood the network with counterfeit wallets or nodes, then use that numerical advantage to sway consensus, steal funds, or hijack governance. If you’ve ever wondered why a DAO vote suddenly swings toward a suspicious proposal, or how a token airdrop can be drained in minutes, you’re probably looking at a Sybil‑driven exploit.

TL;DR

- Sybil attacks flood a blockchain with fake identities to manipulate consensus or governance.

- Major real‑world cases include Ethereum Classic’s 2020 51% attacks and Verge’s node‑spam assaults.

- Proof‑of‑Work (Bitcoin) is the most expensive foothold, while Proof‑of‑Stake and DeFi platforms are easier targets.

- Defenses range from costly mining to quadratic voting, reputation systems, and token‑gated entry.

- Follow a checklist: diversify node locations, audit governance votes, and use Sybil‑resistant identity layers.

What Exactly Is a Sybil Attack?

A Sybil attack gets its name from a 1973 novel about a woman with multiple personalities. In crypto, the “multiple personalities” are thousands of pseudo‑anonymous wallets or nodes that all belong to the same attacker. Because most blockchains treat every address as equal, the network can’t tell a genuine user from a bot‑generated cluster.

Typical steps look like this:

- Generate a large set of wallet addresses using scripts or a botnet.

- Fund each wallet just enough to cover transaction (gas) fees.

- Interact with the target protocol - vote, stake, provide liquidity, or submit blocks.

- Harvest the payoff, whether it’s a governance token, an airdrop, or a double‑spend reward.

The attack’s success hinges on two things: low identity‑verification cost and a high‑value payoff that outweighs the expense of creating fake accounts.

How Sybil Attacks Play Out in Cryptocurrency Networks

Cryptocurrency ecosystems are built on two pillars: pseudonymity and decentralization. Pseudonymity means anyone can spin up a new address without a real‑world ID check. Decentralization means the network trusts the majority of participants, not a central authority. When those pillars meet, they create a perfect launchpad for Sybil attacks.

Different consensus mechanisms change the economics of the attack:

- Proof‑of‑Work (PoW) - Mining requires massive computational power. Creating a new miner node is expensive, which makes large‑scale Sybil attacks prohibitive. Bitcoin’s 21million‑coin cap and energy cost act as natural deterrents.

- Proof‑of‑Stake (PoS) - Staking only needs a token deposit. An attacker can buy cheap tokens, split them across many wallets, and appear as many validators. The barrier is lower, so PoS chains need extra Sybil‑resistance tricks.

- Delegated Proof‑of‑Stake (DPoS) - Validators are elected by token holders. If an attacker amasses enough delegated votes via Sybil wallets, they can control block production.

Beyond consensus, DeFi platforms add layers of vulnerability. A DAO that awards voting power strictly by token balance invites “token‑splitting” attacks - the attacker breaks a large stake into thousands of tiny accounts to flood the vote.

Notable Real‑World Sybil Attack Cases

Below are the most widely documented incidents that illustrate how Sybil attacks translate into tangible losses.

Ethereum Classic - August 2020 51% Reorganizations

Ethereum Classic (ETC) suffered a series of 51% attacks where an adversary controlled more than half of the network’s mining power. While the term “51% attack” is a specific fork‑reorg technique, the underlying method resembled a Sybil attack: the attacker rented cloud‑based hash power, effectively creating a massive, temporary mining identity that dwarfed honest miners. The result? Two block reorganizations that erased over $30million worth of transactions and forced exchanges to pause ETC withdrawals.

Verge - Node‑Spam Sybil Assault (2019)

Verge, a privacy‑focused blockchain, was hit by a coordinated spam of fake masternodes. By launching thousands of low‑powered nodes, the attacker flooded the network’s peer‑discovery mechanism, slowing transaction propagation and increasing confirmation times. Although no funds were directly stolen, the attack showcased how a Sybil assault can degrade user experience and erode confidence.

DeFi Governance Manipulation - “Pump‑and‑Dump” DAO Vote (2022)

In a popular DeFi protocol, an attacker created 8,000 fresh wallets, each holding the minimum amount of governance tokens required to vote. Using a scripted voting bot, they pushed through a proposal that redirected a portion of the protocol’s treasury to a wallet they controlled. The move netted roughly $2.1million before the community caught on and rolled back the change.

Airdrop Farming - Multiple Wallet Harvest (2023)

When a layer‑2 scaling solution announced a massive token airdrop, a botnet spun up 12,000 wallets, performed minimal transaction activity, and claimed the free tokens. The attacker walked away with over $4million worth of newly minted coins, leaving genuine early adopters with a fraction of the original allocation.

The Ripple Effects: Why Sybil Attacks Matter Beyond Money

Financial loss is the headline, but the deeper damage spreads across the ecosystem:

- Governance distortion: Fake votes can push protocol upgrades that favor attackers, potentially locking out honest users.

- Network disruption: Flooded peer lists slow block propagation, increasing the chance of accidental forks.

- Trust erosion: Communities lose faith in the fairness of token distributions and voting mechanisms.

- Privacy leakage: Attackers can map IP addresses of honest nodes by surrounding them with malicious peers, compromising anonymity.

All these factors undermine the core promise of blockchain: a trustless, transparent system where participants can interact without fear of manipulation.

Defensive Playbook: How Networks Fight Back

There’s no single silver bullet, but a layered approach dramatically raises the cost for an attacker.

Consensus‑Level Barriers

- Proof‑of‑Work: High energy and hardware costs naturally limit the number of viable miners.

- Hybrid models: Some chains combine PoW with PoS, forcing attackers to both buy tokens and invest in mining hardware.

- Stake‑weight caps: Limiting the maximum stake any single address can hold reduces the impact of token‑splitting.

Governance‑Level Safeguards

| Technique | How It Works | Pros | Cons |

|---|---|---|---|

| Quadratic Voting | Voting power = sqrt(number of tokens) | Reduces impact of large token holders | Complex to implement, may penalize genuine large investors |

| Reputation‑Based Voting | Weight assigned based on on‑chain activity age | Encourages long‑term participation | New users may feel excluded |

| Token‑Gated Access (NFTs) | Only holders of a specific NFT can vote | Creates a tangible barrier for bots | Can centralize power if NFT distribution is uneven |

| Identity Anchors (KYC/Attestations) | Link wallet to a verified identity or social proof | Greatly raises creation cost for fake accounts | Potentially conflicts with privacy goals |

Network‑Level Tactics

- Peer‑rate limiting: Nodes reject connections that exceed a threshold of new peers per hour, slowing botnet infiltration.

- Sybil‑resistant peer discovery: Protocols like Kademlia can weight peer IDs based on uptime, discouraging short‑lived fake nodes.

- Economic penalties: Slash stakes of validators that propose invalid blocks, turning an attack into a losing gamble.

Quick Checklist: Spotting a Potential Sybil Attack

- Sudden surge in new wallet addresses interacting with a contract.

- Many votes coming from accounts with just enough tokens to meet the minimum.

- Unusual clustering of IP addresses in node logs.

- Rapid, repeated airdrop claims from newly created wallets.

- Sharp increase in gas fees without corresponding on‑chain activity.

If you notice two or more of these signs, investigate the transaction patterns and consider tightening your governance or node‑acceptance rules.

Future Outlook: What’s Next in the Arms Race?

Researchers at companies like Chainlink and Lightspark are already building native identity layers that embed verifiable credentials directly into wallet addresses. Meanwhile, newer consensus designs such as Proof‑of‑History or Verifier‑Based Consensus aim to prove not just computational work but also the uniqueness of a node.

For developers and community leaders, the key takeaway is to stay ahead of the curve: adopt multi‑factor identity checks, experiment with quadratic voting, and keep an eye on evolving research. The more friction you add for fake identities, the harder it becomes for attackers to profit.

Frequently Asked Questions

Can a Sybil attack happen on Bitcoin?

In theory, yes - an attacker could spin up many mining nodes - but the massive electricity and hardware costs make it economically unfeasible. Bitcoin’s Proof‑of‑Work acts as a natural deterrent.

How do DeFi protocols detect token‑splitting attacks?

Many platforms monitor address creation rates, voting patterns, and token age. Sudden spikes of new, low‑balance wallets voting on the same proposal trigger alerts, prompting a manual review before execution.

Is using KYC a viable solution for blockchain anonymity?

KYC adds a strong Sybil barrier but conflicts with the privacy ethos of many crypto projects. Some hybrids use optional attestations: users can prove they’re unique without exposing full identity.

What’s the difference between a 51% attack and a Sybil attack?

A 51% attack specifically targets the consensus layer by controlling a majority of mining or staking power. A Sybil attack is broader - it can target consensus, governance, or any system that trusts the number of participants. A 51% attack often uses Sybil tactics to amass the needed power.

Which consensus mechanism is the most Sybil‑resistant today?

Proof‑of‑Work remains the most costly to subvert, but newer hybrid models that combine PoW with economic penalties (e.g., slashing) are emerging as strong contenders. The choice often balances security, energy use, and decentralization goals.

Kate Roberge

June 10, 2025 AT 05:10Another guide preaching the same tired Sybil nonsense.

Oreoluwa Towoju

June 18, 2025 AT 18:44If you’re watching for sudden wallet bursts, set an alert on new address creation rates; it helps spot a coordinated spam early.

Lindsay Miller

June 27, 2025 AT 08:17I get why these attacks shake our confidence. The community depends on honest participants, and a flood of fake identities feels like a personal betrayal.

Katrinka Scribner

July 5, 2025 AT 21:50Wow, this is intense! 😱 The way these bots swarm the network is like a digital zombie apocalypse. Stay safe, folks! 🛡️

Waynne Kilian

July 14, 2025 AT 11:24Let’s remember that no system is perfect; while Sybil attacks expose vulnerabilities, they also push developers to build stronger defenses. Collaboration over blame will get us further.

Naomi Snelling

July 23, 2025 AT 00:57What they don’t tell you is that these “research papers” are funded by shadowy groups who want to keep the power centralized. Every time a token gets airdropped, the same players reap the reward.

april harper

July 31, 2025 AT 14:30In the grand theater of blockchain, the Sybil troupe always steals the spotlight, leaving the audience bewildered.

Carl Robertson

August 9, 2025 AT 04:04The warning you issued is spot‑on, yet the community often dismisses such dramatics as mere hype. In reality, the economics of creating thousands of cheap wallets have shifted dramatically with cheap cloud services. Attackers can now spin up a botnet in minutes, each node masquerading as a legitimate participant. This influx skews consensus mechanisms that rely purely on node count rather than stake weight. Proof‑of‑Stake protocols, while mitigating raw computational costs, inadvertently lower the barrier to identity duplication. When a token’s governance model ties voting power directly to balance, splitting that balance across many addresses multiplies influence. The result is a kind of “vote‑splitting” where the attacker’s total voting weight remains constant, but the network perceives a flood of distinct voices. Such manipulation can pass proposals that siphon funds or adjust parameters in favor of the attacker. Moreover, the psychological impact on honest participants cannot be ignored; trust erodes faster than any monetary loss. Communities that react by tightening rules without clear communication may alienate legitimate users. A balanced approach involves coupling stake weight with reputation signals such as longevity or activity proof. Implementing quadratic voting can further dilute the advantage of token‑splitting attacks. Yet, any added complexity must be weighed against usability, lest the system become inaccessible to newcomers. Ultimately, the arms race will continue, and vigilance combined with layered defenses is our best hope. So, while your poetic warning captures attention, the technical countermeasures must evolve in lockstep.

Rajini N

August 17, 2025 AT 17:37Here’s a quick checklist: monitor new address creation spikes, flag votes from accounts holding just the minimum required tokens, and audit IP clustering in node logs. Implementing a minimum staking period can also deter short‑lived Sybil nodes.

Jason Brittin

August 26, 2025 AT 07:10Nice list! 😏 Just remember that too many rules can scare away legit participants.

Amie Wilensky

September 3, 2025 AT 20:44When analyzing Sybil patterns, one must consider transaction frequency, token age, and network latency; these variables, combined, create a multi‑dimensional risk profile, and ignoring any single factor can lead to false security, which in turn, may cause the very vulnerabilities we aim to mitigate.

MD Razu

September 12, 2025 AT 10:17Philosophically, a Sybil attack challenges the core assumption of decentralization: that every node is an independent rational actor. By collapsing many actors into a single malicious entity, the network’s emergent properties are distorted, leading to outcomes that were never anticipated by the original protocol designers. This distortion reveals a hidden fragility in any system that equates quantity with trust. Consequently, designers must embed qualitative assessments-such as reputation, historical behavior, and cross‑chain identity verification-into the consensus algorithm. Without such measures, the network remains susceptible to the classic “one voice, many masks” problem, which undermines both security and governance.

Charles Banks Jr.

September 20, 2025 AT 23:50Sure, add more layers and hope the bots get confused.

Ben Dwyer

September 29, 2025 AT 13:24Stay focused on solid fundamentals; a strong community can often spot and reject suspicious activity before it spreads.

VICKIE MALBRUE

October 8, 2025 AT 02:57Keep your eyes open and keep learning.

Michael Wilkinson

October 16, 2025 AT 16:30Stop whining about Sybil attacks and start building real defenses; the laziness of many projects is the real problem.

Billy Krzemien

October 25, 2025 AT 06:04For those looking to harden their protocols, consider integrating verifiable credentials that link a wallet to a unique, privacy‑preserving identifier.

Clint Barnett

November 2, 2025 AT 18:37When you think about the evolution of Sybil resistance, picture a tapestry woven from many threads: cryptographic proof‑of‑work fibers, reputation‑based yarn, and identity‑anchored silk. Each strand adds a layer of resilience, but if one frays-say, due to a cheap cloud‑compute surge-the entire fabric can be compromised. That’s why a diversified approach, blending economic costs with social trust signals, creates a more durable shield. Embrace the colorful toolbox: slashing, quadratic voting, and decentralized KYC‑lite solutions, all while keeping the user experience smooth enough that honest participants stay engaged. In short, don’t rely on a single trick; mix and match to stay ahead of attackers.

Jacob Anderson

November 11, 2025 AT 08:10Looks like another endless Sybil tutorial for the masses.