Cross-Chain Laundering Flow Simulator

Visualize the laundering process

Explore how stolen crypto moves through multiple blockchain networks using cross-chain bridges, as described in the article about DPRK hacking techniques.

Simulate the starting point of a typical laundering operation:

Choose which bridge the hackers would use to move funds:

How effective is this laundering method?

Estimated Laundering Efficiency

85% of funds successfully laundered across multiple chains

Based on recent TRM Labs data: over 9,500 BTC moves via Avalanche Bridge within a 48-hour window

Cross-chain crypto laundering by DPRK hackers is an advanced money‑shrouding technique where North Korean cyber actors move stolen digital cash through multiple blockchain networks to hide its origin. The method leans on interoperable bridge services, rapid swaps, and automated scripts that flood analysts with thousands of transactions per minute. Understanding how the regime pulls this off helps exchanges, investigators, and everyday users spot warning signs before the cash disappears into the dark.

Who’s behind the operation?

The mastermind group is known as the Lazarus Group, a subdivision of the DPRK’s Reconnaissance General Bureau. Different teams - often called TraderTraitor or the 3rd Bureau - launch the hacks, steal the crypto, and then hand the loot over to a laundering unit that specializes in cross‑chain hopping. In February 2025 the group stole over $1.5billion from the crypto exchange Bybit, setting a new record for a single crypto heist.

Why cross‑chain bridges matter

The cross-chain crypto laundering trend began when analysts noticed a sharp rise in traffic through bridge services such as Ren Bridge and Avalanche Bridge. Unlike traditional mixers that keep the same asset on a single chain, bridges let hackers swap Bitcoin for Ether, then flash‑swap to Tron, BTTC, or even obscure chains that receive little scrutiny from analytics firms. By marching the loot across three or more blockchains in seconds, the thieves break the chain of custody and force investigators to chase a moving target.

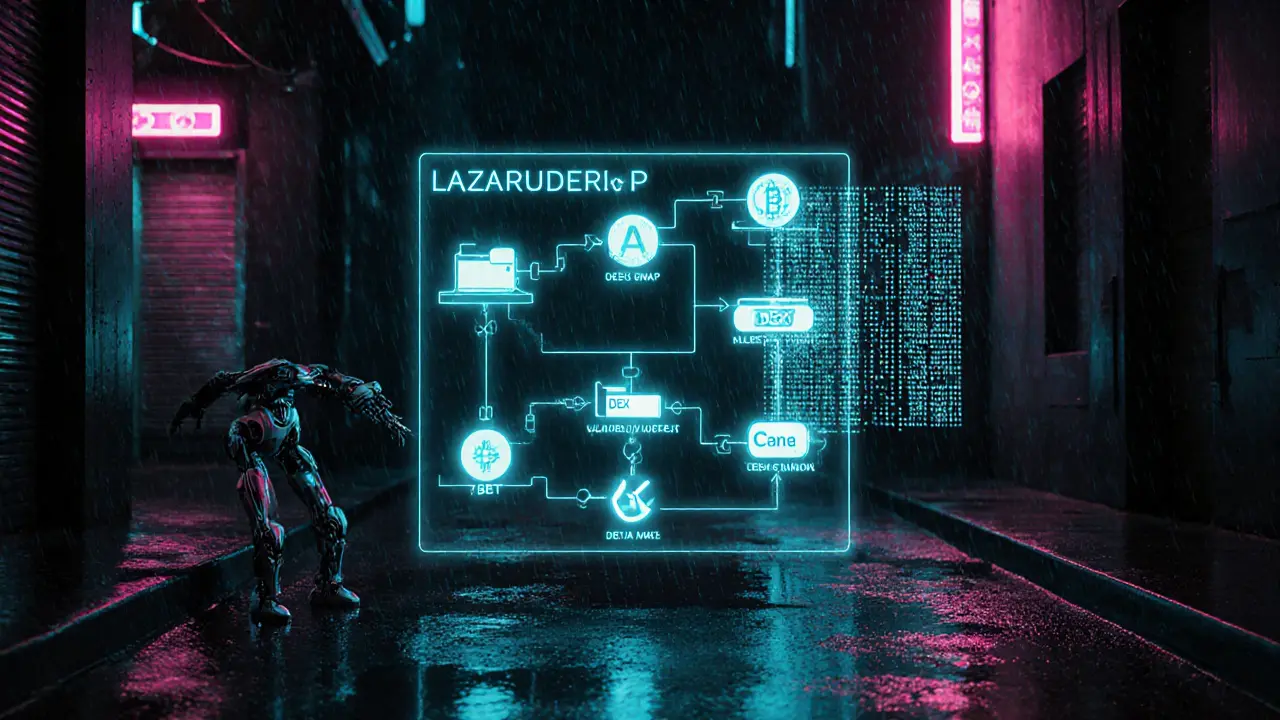

Step‑by‑step: the typical laundering flow

- Initial breach - a phishing lure or exploit drains wallets on Ethereum, Bitcoin, or other high‑value chains.

- Rapid aggregation - stolen tokens are pooled into freshly generated addresses controlled by the attackers.

- Bridge hopping - the pool is sent through a bridge (e.g., Ren Bridge) to another chain, often converting ERC‑20 tokens to native Ether.

- Decentralized exchange (DEX) swaps - on the new chain the assets are swapped for a more liquid token (usually Bitcoin or USDT) using platforms like Uniswap, PancakeSwap, or Raydium.

- Obscure‑chain bounce - a portion lands on low‑visibility networks (e.g., BTTC, Solana) where on‑chain analysis coverage is thin.

- Refund address reset - the funds are redirected to a brand‑new address, breaking the transaction graph.

- OTC or exchange off‑ramp - the final BTC or stablecoin batch is sold over the counter or deposited on a centralized exchange under false identities.

This chain‑hopping loop can repeat dozens of times, creating a “flood the zone” effect that overwhelms compliance tools. According to TRM Labs, the Bybit breach alone generated over 9,500BTC moves via Avalanche Bridge within a 48‑hour window.

From mixers to bridges: a shifting landscape

Before 2022 the Lazarus Group relied heavily on mixers like Sinbad, YoMix, Wasabi Wallet, and CryptoMixer. After global crackdowns on mixers (notably Tornado Cash), the group pivoted to cross‑chain routes. Elliptic reported a 111% surge in funds processed through bridge services after the shift. The move reflects two key advantages:

- Speed - Bridges settle in seconds, outpacing manual mixing cycles that can take days.

- Volume - High‑frequency swaps flood analytics dashboards, making it harder to spot a single illicit flow.

Traditional mixers still appear in the workflow, but only as a final “clean‑up” step after the bulk of the laundering has already taken place on multiple chains.

How investigators fight back

Blockchain forensics firms have responded with cross‑chain tracing tools. TRM Labs launched TRM Phoenix in 2022, automatically linking transactions across bridges. Chainalysis now incorporates bridge‑specific heuristics in its 2025 Crypto Crime Report. These platforms pull together on‑chain data, open‑source intelligence, and proprietary threat feeds to generate visual graphs that show the full laundering pipeline.

Law‑enforcement agencies also play a role. The FBI issued advisories in August 2023 urging exchanges to freeze wallets linked to known Lazarus addresses. The UN has called the activity a direct financing source for the DPRK’s weapons programs, prompting member states to strengthen sanctions on crypto‑related entities.

Comparison: Traditional Mixers vs Cross‑Chain Bridge Laundering

| Method | Typical Platform | Key Advantage | Main Weakness |

|---|---|---|---|

| Mixing (coin‑tumbling) | Wasabi, Tornado Cash, CryptoMixer | Obfuscates origin on a single chain | Slow, increasing regulatory pressure, address tagging |

| Cross‑chain bridge hopping | Ren Bridge, Avalanche Bridge, Wormhole | Fast, high‑volume, spans multiple ecosystems | Complex detection requires cross‑chain analytics, bridge contracts can be seized |

Economic & geopolitical impact

The scale is staggering: $660.5million stolen in 2023, $1.34billion in 2024, and over $2billion in 2025 according to multiple analytics firms. A senior Biden administration official warned that roughly half of North Korea’s foreign‑currency earnings now come from cyber‑crime, with crypto theft being the fastest‑growing slice. The United Nations has linked these revenues directly to the regime’s missile and nuclear programs, turning crypto laundering into a matter of global security rather than a niche crime.

Future outlook: what to expect

Analysts see three trends shaping the next wave of DPRK laundering:

- More human‑targeted attacks - Phishing, fake job offers, and deep‑fake social engineering will replace many technical exploits, expanding the pool of vulnerable high‑net‑worth individuals.

- Obscure‑chain diversification - Hackers will experiment with emerging Layer‑2 solutions and niche networks where analytics coverage is still thin.

- Automated “flood‑the‑zone” bots - AI‑driven scripts will generate thousands of micro‑transactions per second, making real‑time detection almost impossible without dedicated cross‑chain monitoring.

Staying ahead means that exchanges, custodians, and regulators must invest in cross‑chain forensic tools, share address intelligence quickly, and enforce strict KYC/AML checks on bridge‑related activity.

Frequently Asked Questions

What exactly is a cross‑chain bridge?

A cross‑chain bridge is a smart‑contract‑based system that lets users move tokens from one blockchain to another. The bridge locks the original asset on the source chain and mints an equivalent token on the destination chain, enabling seamless swaps across ecosystems.

Why are traditional mixers less effective against North Korean hackers now?

Since 2022 regulators have seized or sanctioned many mixers, and global AML frameworks now require exchanges to screen mixer‑related addresses. The Lazarus Group therefore shifted to bridges, which are harder to block because they are integral parts of many DeFi protocols.

Can ordinary crypto users protect themselves from these attacks?

Yes. Use hardware wallets, enable multi‑factor authentication, verify URLs carefully, and never share private keys. Treat unsolicited job offers or investment pitches with extreme suspicion, as they’re common phishing vectors for the Lazarus Group.

How do law‑enforcement agencies trace funds across multiple blockchains?

Investigators rely on cross‑chain analytics platforms (e.g., TRM Phoenix, Chainalysis Reactor) that map bridge contracts, monitor address clustering, and combine on‑chain data with open‑source intelligence. This creates a unified graph that shows where the money started and where it’s headed.

What sanctions are in place against DPRK crypto activities?

The UN Security Council imposes comprehensive sanctions on North Korean financial activities, including crypto. The U.S. Treasury’s OFAC adds specific wallet addresses linked to the Lazarus Group to its Specially Designated Nationals (SDN) list, making any transaction with those addresses illegal for U.S. persons.

Hari Chamlagai

October 13, 2025 AT 08:34The pattern described isn’t new; North Korean actors have been perfecting cross‑chain hopping for years. Their playbook shows a ruthless efficiency that outpaces most private‑sector threat actors. By leveraging bridges, they bypass the bottlenecks of traditional mixers and force analysts to chase phantom trails. The speed of these hops also strains the capacity of many compliance engines, which were designed for single‑chain transactions. In short, the regime treats blockchain as a high‑speed freight corridor for illicit cash.

Ben Johnson

October 18, 2025 AT 09:59Oh great, another crypto‑laundering tutorial, because we totally needed more homework.

Cynthia Chiang

October 23, 2025 AT 11:24If you're a regular user, remember that a hardware wallet and two‑factor authentication can stop most phishing attempts.

The Lazarus playbook is sophisticated, but the first line of defence is still basic hygiene.

Keep your private keys offline and double‑check any link that asks for credentials.

Even a small mistake can feed the bridge‑hopping pipeline.

Stay vigilant, and share these tips with anyone who trades crypto.

Sorry for the tyops, but the message matters.

Jason Clark

October 28, 2025 AT 11:48Bridge hopping is essentially a decentralized money‑laundering conveyor belt, and the only thing slower than the process is the regulatory response.

The technique exploits the trustless nature of smart contracts, so you can't simply block a bridge without disrupting legitimate DeFi traffic.

Think of it as trying to shut down an airport because smugglers use it.

If you want to mitigate risk, monitor large bridge withdrawals and flag address clustering.

In the meantime, enjoy the ride while the analysts scramble.

Jim Greene

November 2, 2025 AT 13:13Nice breakdown! 🙌 This shows why community awareness matters – the more we know, the harder it gets for bad actors to hide.

If exchanges adopt real‑time bridge monitoring, we can cut the funnel before the loot reaches the final chain.

Keep sharing these insights, and let's turn the tables on the hackers. 🚀

Bruce Safford

November 7, 2025 AT 14:38What they don’t tell you is that many of those bridge contracts are secretly owned by state‑sponsored groups, and the so‑called "legitimate" DeFi traffic is just a cover.

The data feeds you rely on are filtered through backdoors, so the whole analysis pipeline is compromised.

You think you’re watching the bridge, but you’re actually watching a puppet show.

It’s all part of a larger cyber‑war that the mainstream media refuses to acknowledge.

Steve Cabe

November 12, 2025 AT 16:02The United States cannot afford to sit idly by while North Korean hackers exploit our financial infrastructure.

Their cross‑chain laundering operations directly fund a regime that threatens global stability.

Every dollar that slips through a bridge is a dollar that could have bolstered our own defense programs.

It is incumbent upon American regulators to tighten the noose around these illicit pathways.

The first step is to mandate real‑time reporting of all bridge transactions exceeding a modest threshold.

Second, we must require that any smart‑contract code interacting with a bridge undergoes a rigorous security audit vetted by a federal agency.

Third, exchanges should be obligated to freeze any address flagged by a consortium of intelligence firms within hours, not days.

Moreover, the Department of the Treasury should expand the OFAC list to include not only wallet addresses but also the underlying bridge contract identifiers.

This will make it legally risky for any U.S. person to engage with the services that North Korea relies upon.

In addition, we need to allocate more resources to the Cybersecurity and Infrastructure Security Agency to develop cross‑chain forensics tools.

The current patchwork of analytics platforms is insufficient; a coordinated national effort is required.

Private sector partners can contribute by sharing anonymized transaction data under strict privacy safeguards.

International cooperation is also vital, because the bridges operate on a global network that transcends borders.

By working with allies to standardize reporting requirements, we can close the gaps that the Lazarus Group currently exploits.

Finally, public awareness campaigns should educate everyday users about the dangers of interacting with unknown bridge services.

Only through a comprehensive, all‑of‑the‑above strategy can we hope to starve the North Korean cyber‑crime machine of its lifeblood.

Jordan Collins

November 17, 2025 AT 17:27From a compliance perspective, a layered approach yields the best results.

Begin with on‑chain monitoring of bridge contracts, then integrate off‑chain intelligence from known Lazarus addresses.

Apply clustering algorithms to detect address reuse across multiple chains.

Finally, enforce stricter KYC/AML checks for any entity that requests large bridge withdrawals.

This methodology reduces false positives while catching the high‑value flows.

Andrew Mc Adam

November 22, 2025 AT 18:52Look, the bridge‑hopping saga is like a high‑speed train sprinting through a dark tunnel, and we are the blind passengers.

The Lazarus crew throws grenades of transaction spams, and our analysts scramble to catch the sparks.

If we don’t upgrade our tracking tools, the loot will keep vanishing into the abyss.

The drama isn’t just in the headlines, it’s in the wallets that get drained.

So, tighten those security meshes before the next wave hits!

Scott G

November 27, 2025 AT 20:17I concur with the necessity of robust cross‑chain surveillance.

The proposed measures merit immediate consideration.

Ken Lumberg

December 2, 2025 AT 21:41Patriotism demands that we act without hesitation; any delay only fuels the enemy’s coffers.

The moral imperative is clear: protect our financial system at all costs.

By enforcing stringent bridge controls, we uphold the values that define our nation.

Let us not falter in this critical battle.

Blue Delight Consultant

December 7, 2025 AT 23:06Contemplating the ethical dimension of crypto laundering reveals a paradox: the very tools that empower decentralization also enable oppression.

When a state weaponizes anonymity, the moral ledger tilts dramatically.

Scholars must dissect this duality and propose frameworks that balance freedom with accountability.

It is a subtle dance between liberty and security, and the steps are still being written.

Gautam Negi

December 13, 2025 AT 00:31Contrary to popular belief, the bridge phenomenon will soon be rendered obsolete by quantum‑proof protocols.

Shauna Maher

December 18, 2025 AT 01:55If you think this is just about money, you’re missing the deeper agenda of global domination.

The elite are definitely pulling the strings behind these bridges.

Kyla MacLaren

December 23, 2025 AT 03:20I agree with the need for community education.

Simple guides can make a big difference for new traders.

Linda Campbell

December 28, 2025 AT 04:45The exploitation of cross‑chain bridges by the DPRK is an affront to international order, and it must be met with decisive punitive action.

Sanctions should target not only the wallets but also the developers who facilitate these services, thereby cutting off the technical lifeline of the regime.

John Beaver

January 2, 2026 AT 06:09Yo, just make sure ya double check the bridge fees before you jump in.

Marques Validus

January 7, 2026 AT 07:34Alright folks strap in we are diving deep into the wild world of cross‑chain laundering.

The Lazarus crew treats each bridge like a high‑speed highway for dirty cash.

They piggy‑back on liquidity pools and flash loans to mask the origin.

Analytics teams get flooded with micro‑transactions that look legit.

Meanwhile the bad actors hop from Ethereum to Avalanche to Solana with the click of a smart contract.

Regulators are left chewing on stale reports while the money disappears.

What’s the fix you ask well first you need integrated monitoring across all layers.

Second deploy AI bots that flag anomalous bridge activity in real time.

And third you gotta educate users about the hidden fees and risks.

Only then can we hope to outrun the next wave of cyber‑crime.