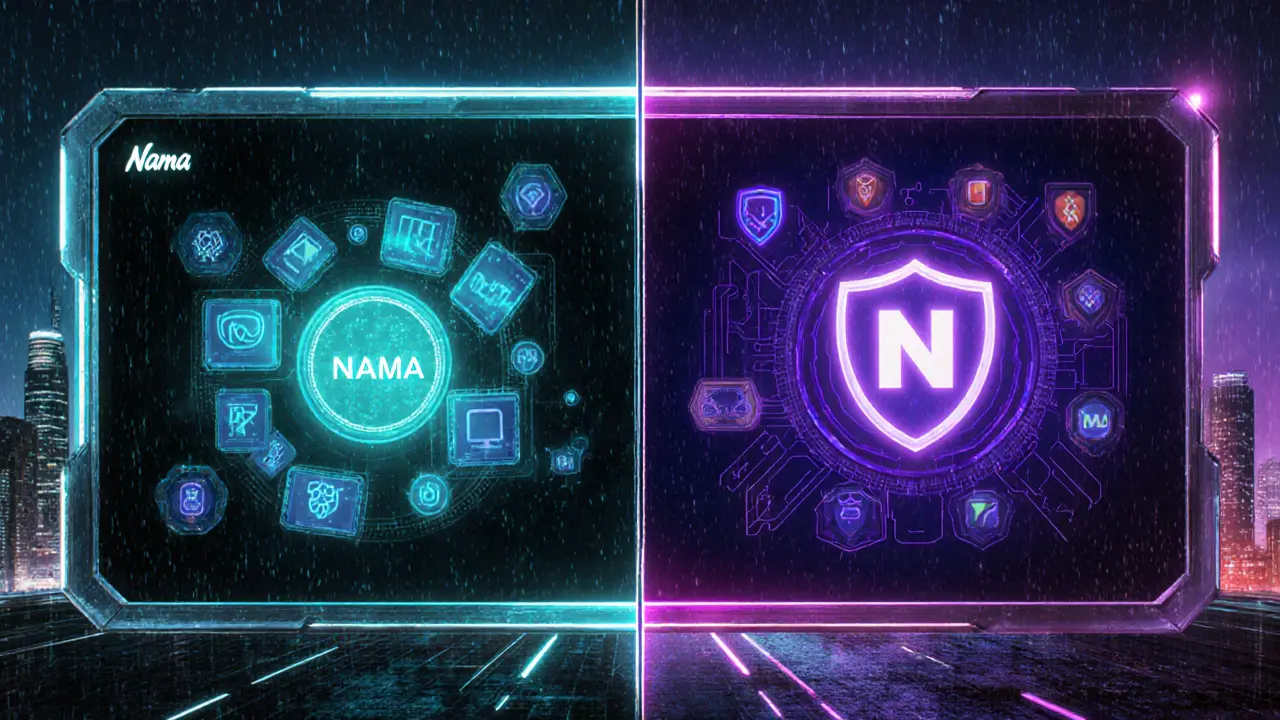

Nama Finance vs Namada Comparison Tool

Focuses on NFT-collateral loans and cross-chain liquidity. No public airdrop announced.

- Max Supply: 1 billion

- Circulating Supply: 0

- APY: Up to 35%

- Airdrop: None

Privacy-first multichain hub with shielded assets. Distributed 65 million NAM tokens.

- Total Supply: ~1 billion

- Airdropped: 65 million (6.5%)

- APY: Staking rewards

- Airdrop: Ended Dec 28, 2024

Airdrop Eligibility Checker

Check if you qualify for the Namada (NAM) airdrop based on these criteria:

NAMA Protocol has been floating around crypto forums with promises of a massive airdrop. But what’s the real story? Is the airdrop coming from Nama Finance, or is it actually tied to a different project called Namada? This guide clears up the confusion, walks you through the genuine Namada (NAM) airdrop that already happened, and explains why Nama Finance’s NAMA token hasn’t offered a comparable drop.

TL;DR

- Nama Finance’s NAMA Protocol focuses on NFT‑collateral loans and does NOT run a large airdrop.

- The real airdrop was by the Anoma Foundation’s Namada protocol, distributing 65million NAM tokens.

- Eligibility for the Namada airdrop covered developers, ZK researchers, ATOM/OSMO stakers, BadKid NFT holders, and Gitcoin donors.

- Claiming ended on 28December2024; the drop is now closed.

- If you’re looking for NFT‑liquidity services, Nama Finance’s NAMA token rewards come from lending‑pool yields, not airdrops.

What Is Nama Finance’s NAMA Protocol?

Nama Finance operates a NAMA Protocol that lets NFT owners lock their assets as collateral to borrow stablecoins across multiple chains (Ethereum, Binance Smart Chain, Solana). Lenders stake stablecoins (USDT, USDC, DAI) in liquidity pools and earn NAMA token rewards that can reach up to 35% APY when lending against high‑value NFTs. The platform markets itself as a "fully decentralized and community‑driven NFTs liquidity protocol".

Key features include:

- Cross‑chain collateralization - an NFT minted on Ethereum can secure a loan on Solana.

- Dynamic interest rates - borrowers pay as low as 5%/year, lenders earn variable yields based on pool utilization.

- Governance - NAMA token holders can vote on fee structures and new asset support.

Despite the buzz, the NAMA token has never seen a public airdrop. CoinMarketCap lists a max supply of 1billion, but both total and circulating supplies are shown as zero, and the 24‑hour trading volume is $0. This suggests the token is either pre‑launch or has very limited market exposure.

Enter the Namada (NAM) Protocol - The Real Airdrop Hero

Confusion stems from the similarity between “NAMA” and “NAM”. The Anoma Foundation’s Namada protocol launched a massive Retroactive Public Goods Funding (RPGF) airdrop. In total, 65million NAM tokens-6.5% of the total supply-were distributed to contributors of the ecosystem.

Why did Namada do this? Co‑founder Christopher Goes said the drop was “part of our attempt to give some ownership back to the creators and supporters of those goods”. The airdrop rewarded:

- Developers and researchers building zero‑knowledge (ZK) and privacy tools.

- Public contributors to Zcash and the Rust language.

- Gitcoin donors who funded ZK‑tech projects.

- Stakers of ATOM and OSMO who held at least $100 worth of tokens by 1Nov2024.

- Holders of the BadKid NFT (minimum one) by 14Nov2024, with each NFT yielding $200‑$300 worth of NAM.

The claim portal (rpgfdrop.namada.net) closed on 28December2024. All eligible participants who submitted a Genesis Namada account received their allocations automatically.

Technical Spotlight: What Makes Namada Different?

Namada isn’t just another privacy chain; it pushes the envelope with two core innovations:

- Multi‑Asset Shielded Pool (MASP) - an extension of Zcash’s Sapling circuit that can hide any asset type, from ATOM to NFTs, in a single privacy set. This means you can privately transfer an NFT and a native token in one proof.

- Cubic Proof‑of‑Stake (CPoS) - a consensus model that imposes cubic slashing penalties for validator misbehavior, dramatically increasing the cost of coordinated attacks.

Both features run on a Cosmos‑compatible IBC layer, letting users move assets across chains without sacrificing anonymity.

Why the Confusion Matters for Investors

If you’re hunting a free token, mistaking Nama Finance’s NAMA for Namada’s NAM can cost you time and credibility. The primary risks are:

- Missing the real airdrop: The Namada drop closed months ago. Chasing rumors about a new NAMA airdrop will lead nowhere.

- Liquidity risk: NAMA tokens currently have no market depth, making it hard to sell if you acquire them through private sales.

- Regulatory exposure: NFT‑collateral platforms are under increased scrutiny in several jurisdictions. Nama Finance’s cross‑chain lending model could face compliance hurdles.

Do your homework: verify official URLs, check GitHub activity, and read recent community updates before committing funds.

Side‑by‑Side: Nama Finance vs. Namada

| Aspect | Nama Finance (NAMA) | Namada (NAM) |

|---|---|---|

| Core focus | NFT‑collateral loans & cross‑chain liquidity | Privacy‑first multichain hub with shielded assets |

| Token name | NAMA | NAM |

| Supply | 1billion max, 0 circulating (as of Oct2025) | ~1billion total, 65million airdropped (6.5% of supply) |

| Airdrop | No public airdrop announced | 65million NAM via RPGF (ended 28Dec2024) |

| Key tech | Cross‑chain NFT collateralization, stablecoin lending pools | MASP, CPoS, IBC‑enabled privacy proofs |

| Typical APY | Up to 35% for NAMA rewards (yield farming) | Staking rewards (varies), governance incentives |

| Current market activity | Zero trading volume, token not listed on major exchanges | Active on several DEXs, governance voting ongoing |

How to Verify Real Airdrop Claims

When you see a headline like “Free NAMA tokens for early adopters”, run through this checklist:

- Check the official website domain. Nama Finance uses

nama.finance; Namada’s site isnamada.net. - Search the project’s GitHub or GitLab for recent commits. Active repos signal live development.

- Look for a public claim portal (e.g.,

rpgfdrop.namada.net). If the link is dead, the airdrop is likely closed. - Read community channels (Discord, Telegram). Real airdrops are announced in multiple places, not just a single tweet.

- Confirm token contract address on a block explorer. Beware of look‑alike contracts.

Applying this process will keep you from falling for phishing scams that mimic official communication.

Next Steps for Interested Users

If you’re still interested in either ecosystem, here’s what you can do right now:

- Nama Finance: Join their Discord, monitor the “Rewards” channel for upcoming farming periods, and test the NFT‑collateral loan feature on a testnet before committing real assets.

- Namada: Participate in the governance forum, stake existing NAM tokens to earn rewards, and explore the MASP demo on the official website to see privacy in action.

Remember, the biggest gains often come from contributing value-writing code, providing liquidity, or supporting community projects-rather than hoping for a surprise airdrop.

Frequently Asked Questions

Did Nama Finance announce an airdrop for NAMA tokens?

No. Nama Finance’s NAMA token rewards come from lending‑pool yields and governance incentives, not from a public airdrop.

When did the Namada (NAM) airdrop happen and is it still claimable?

The RPGF airdrop ran until 28December2024. The claim window is closed, and all eligible participants have received their NAM allocations.

What is the Multi‑Asset Shielded Pool (MASP) and why does it matter?

MASP lets any asset-tokens, NFTs, or even cross‑chain IBC assets-be transferred with zero‑knowledge privacy proofs in a single pool. It expands privacy beyond native coins, allowing truly private multichain transactions.

Can I earn NAMA tokens by providing liquidity?

Yes. By staking stablecoins in Nama Finance’s lending pools you earn NAMA rewards, with APYs that can reach ~35% depending on pool utilization and NFT collateral quality.

Is it safe to borrow against my NFTs on Nama Finance?

The protocol uses over‑collateralization and automated liquidation. However, smart‑contract risk remains, so only use NFTs you can afford to lose and consider test‑net trials first.

Jacob Anderson

April 23, 2025 AT 10:08Oh sure, because every random token launch magically drops free money; the NAMA hype train clearly missed the station.

VICKIE MALBRUE

April 23, 2025 AT 11:20Great to see clear info-no more chasing phantom airdrops.

Katrinka Scribner

April 23, 2025 AT 12:43I wuz sooo excited 😅 but then realized it’s all over 😭 love the privacy vibes tho 🙌

april harper

April 23, 2025 AT 14:40In the grand tapestry of decentralized dreams, the NAMA saga feels like a fleeting whisper, an echo of ambition without substance.

Kate Nicholls

April 23, 2025 AT 16:53The distinction between NAMA and NAM is fundamental; conflating them only shows a lack of basic research.

Waynne Kilian

April 23, 2025 AT 18:16I get the poetic vibe, but the practical risks of NFT‑collateral lending are real-still, the community’s open dialogue helps smooth those edges.

Michael Wilkinson

April 23, 2025 AT 20:13Stop chasing dead airdrop rumors and focus on projects that actually deliver value.

Clint Barnett

April 23, 2025 AT 22:26The NAMA protocol’s promise of NFT‑backed loans is technically intriguing, but the lack of a live market makes the token’s price discovery virtually impossible.

When you pair that with a zero circulating supply, you’re essentially looking at a theoretical asset with no liquidity.

Contrast that with Namada’s NAM token, which not only completed a sizable retroactive public‑goods airdrop but also lists on multiple DEXs, giving it real on‑chain presence.

Moreover, Namada’s multi‑asset shielded pool (MASP) pushes privacy beyond simple coin transfers, allowing confidential movement of NFTs and cross‑chain tokens in a single proof.

That kind of innovation attracts developers who care about true anonymity, which in turn fuels organic demand for the token.

From a yield perspective, NAMA’s 35% APY is attractive on paper, yet it hinges entirely on the platform’s lending pool utilization, a metric that depends on user adoption that has not yet materialized.

Investors chasing that APR often overlook the smart‑contract risk and the possibility of liquidation under market stress.

Namada, on the other hand, offers staking rewards that are more modest but come with the security of a well‑audited proof‑of‑stake design and a clear governance framework.

If you’re evaluating where to allocate capital, consider the difference between speculative yield farming and a token backed by a functioning privacy network.

Regulatory scrutiny is also a factor: NFT‑collateral lending sits in a gray area in many jurisdictions, whereas privacy‑focused chains are already engaging with regulators to define compliant pathways.

Community engagement matters too; Namada maintains active Discord channels, regular governance votes, and transparent roadmaps.

NAMA’s community appears quieter, with fewer public updates, which can be a red flag for long‑term supporters.

Finally, think about the opportunity cost-locking up capital in a token with zero liquidity ties up capital that could be deployed in assets with proven market depth.

In summary, while NAMA’s concept is novel, the practical hurdles and lack of an airdrop make it a high‑risk play; Namada’s completed airdrop, active ecosystem, and privacy innovations present a more substantiated case for interested investors.

Ben Dwyer

April 23, 2025 AT 23:50Your thorough breakdown really clarifies where newcomers should invest their time and attention.

Lindsay Miller

April 24, 2025 AT 01:46If you want to avoid scams, verify the official website and check the contract address on a block explorer.

Naomi Snelling

April 24, 2025 AT 04:00They probably hid the real airdrop behind a private Discord, only the insiders got the chips.

Billy Krzemien

April 24, 2025 AT 05:23While speculation can be entertaining, the publicly available data confirms the NAM airdrop closed on 28 December 2024.

Carl Robertson

April 24, 2025 AT 07:20Another overhyped token, another disappointment.

Rajini N

April 24, 2025 AT 09:00Many projects promise massive returns, yet only those with transparent roadmaps and active codebases tend to survive.

Kate Roberge

April 24, 2025 AT 10:56Even if the NAMA token never airdropped, its yield farming model could still attract risk‑tolerant investors.