Neraex Exchange Risk Assessment Tool

Risk Assessment Results

Key Risk Factors

- Trading Volume: Low volumes can lead to poor liquidity and slippage

- Trading Pairs: Limited pair offerings restrict trading flexibility

- Fees: While competitive, low volume may not benefit from tiered pricing

- Security: Lack of third-party audits increases potential vulnerabilities

- Regulatory Status: Unclear compliance makes it a high-risk option

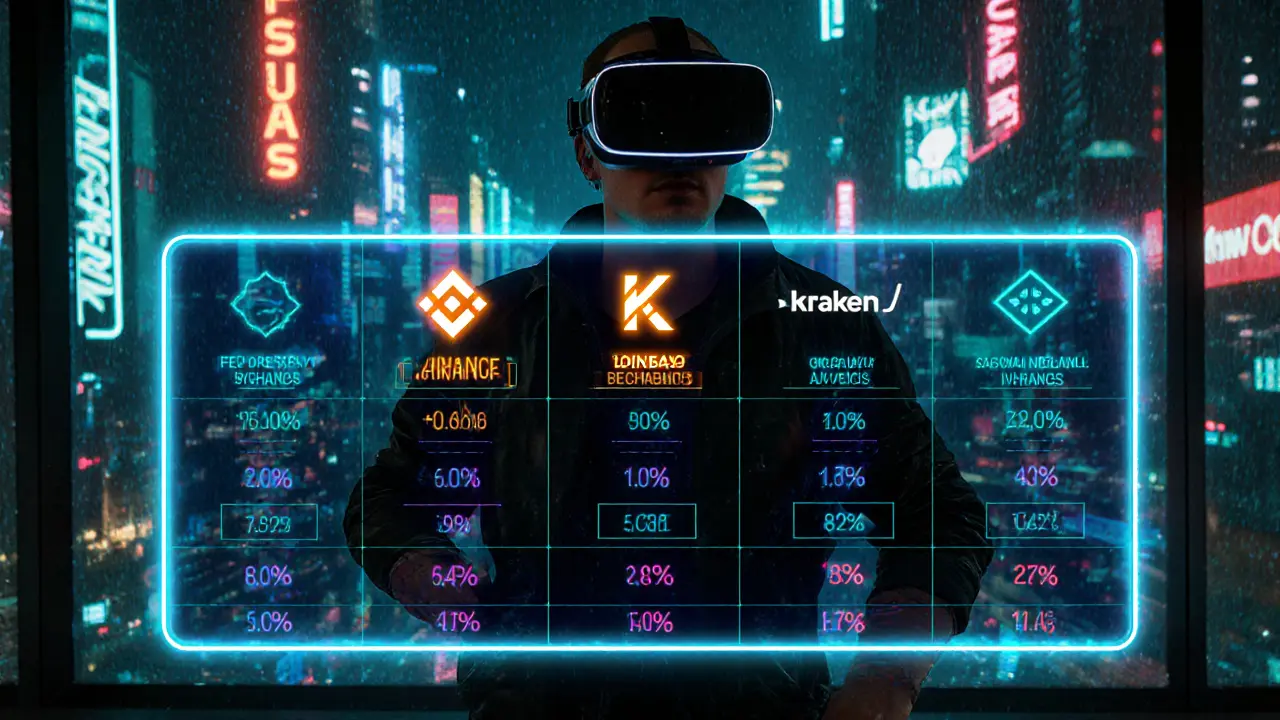

Comparison with Major Exchanges

- Binance: ~$15B daily volume, 0.02%-0.10% fees, regular audits

- Coinbase: ~$2B daily volume, 0.50% taker fee, extensive insurance

- Kraken: ~$800M daily volume, 0.16%-0.26% fees, annual audits

Quick Take

- Limited public data: Neraex shows up on CoinGecko but lacks deep coverage.

- Security basics are present (HTTPS, 2FA), but no public audit reports.

- Regulatory compliance and insurance are unclear - treat it as a high‑risk option.

- Trading fees are competitive on paper, yet volume is modest compared to Binance or Coinbase.

- Best for small‑scale traders who want to experiment, not for large holdings.

When you hear the name Neraex is a cryptocurrency exchange platform that appears on CoinGecko’s listings, offering spot trading for a handful of digital assets., the first question is: does it earn your trust?

In this review we break down the exchange’s security posture, regulatory footing, fee structure, and how it measures up against the industry heavy‑weights. By the end you’ll know whether the Neraex crypto exchange is a place to park a few dollars or a platform to avoid until it proves its mettle.

What Neraex Actually Offers

Neraex currently supports spot trading for major coins such as Bitcoin (BTC), Ethereum (ETH), and a small selection of altcoins. The UI is clean, with a basic order‑book view, market/limit order options, and a dashboard that shows 24‑hour trading volume sourced from CoinGecko. Because the exchange is relatively new, it does not yet provide futures, staking, or margin products.

Key data points (as of October2025):

- 24‑hour trading volume: roughly $12million - modest compared with Binance’s billions.

- Listed on CoinGecko which assigns a trust score based on volume authenticity, security, and compliance.

- Fee schedule: maker 0.15%, taker 0.25% (lower than many mid‑tier exchanges).

Security Features - What’s Visible

Any exchange that handles crypto must start with a solid security foundation. Neraex includes the following publicly disclosed measures:

- HTTPS encryption for all web traffic (SSL/TLS 1.3).

- Support for Two‑Factor Authentication (2FA), which can be enabled via authenticator apps or SMS.

- Optional Multi‑Factor Authentication (MFA) that adds biometric or device‑whitelisting steps for high‑value withdrawals.

- Withdrawal whitelisting - users can pre‑approve wallet addresses.

What the exchange does **not** publish:

- Any third‑party Security Audit reports or bug‑bounty programs.

- Details on cold‑storage architecture - the proportion of assets kept offline is unknown.

- Insurance coverage for theft or hacks.

Without transparent audit results or clear cold‑storage policies, the risk profile remains higher than that of established players.

Regulatory & Compliance Landscape

Compliance is a three‑legged stool: AML, KYC, and licensing. Neraex requires users to complete a basic KYC check (photo ID and proof of address) before they can withdraw funds. It states that it follows Anti‑Money Laundering (AML) guidelines, but no regulator name or license number is displayed on the site.

Contrast this with exchanges like Coinbase, which holds licenses across 50U.S. states and is subject to strict oversight, or Binance, which is registered in multiple jurisdictions and publishes its compliance framework publicly.

Because Neraex’s regulatory status is opaque, users looking for legal protection should treat it as a higher‑risk venue.

Fees, Liquidity, and Trading Volume

Fee structures are often the first metric traders compare. Neraex’s 0.15% maker / 0.25% taker rates look attractive, especially for low‑volume traders. However, the exchange’s thin order book can cause slippage on larger orders.

Liquidity is directly tied to the 24‑hour volume figure reported on CoinGecko. At roughly $12million, the market depth is shallow. By comparison:

- Binance averages $15billion daily.

- Coinbase sees about $2billion.

- Kraken trades near $800million.

If you plan to move more than a few thousand dollars in a single trade, you may experience price impact on Neraex.

How Neraex Stacks Up - A Quick Comparison

| Feature | Neraex | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Spot Trading Pairs | ~15 | ~1,200 | ~100 | ~200 |

| 24‑hr Volume (USD) | $12M | $15B | $2B | $800M |

| Maker / Taker Fees | 0.15% / 0.25% | 0.02% - 0.10% | 0.50% - 0.00% | 0.16% - 0.26% |

| 2FA / MFA | 2FA ✅, MFA optional ✅ | 2FA ✅, MFA ✅ | 2FA ✅, MFA ✅ | 2FA ✅, MFA ✅ |

| Cold Storage % | Not disclosed | ~95% | ~97% | ~94% |

| Security Audits | None public | Regular third‑party audits | Annual SOC 2, ISO‑27001 | Annual audits, bug bounty |

| Insurance Coverage | None disclosed | Up to $200M (selected assets) | Up to $255M (crypto theft) | Limited, case‑by‑case |

| Regulatory Licenses | Unclear | Multiple global licenses | U.S. state & federal | EU & U.S. registrations |

From the table it’s clear that Neraex’s appeal lies mainly in lower fees and a simple UI. The trade‑off is reduced liquidity, vague security disclosures, and uncertain compliance.

User Experience & Support

The platform’s dashboard loads quickly, and the order entry process is straightforward. However, customer support is limited to an email ticket system with a typical response time of 48‑72hours. There is no live chat or phone line, which can be frustrating during urgent issues like withdrawal freezes.

Mobile apps are available for iOS and Android, offering the same basic functionality but lacking advanced charting tools found on larger exchanges.

Risks & Due Diligence Checklist

Because information is scarce, treat Neraex with a healthy dose of skepticism. Before committing funds, run through this quick checklist:

- Verify the exchange’s SSL certificate and confirm the URL ends with https://.

- Enable Two‑Factor Authentication (2FA) immediately after registration.

- Check for publicly posted Security Audit reports or bug‑bounty program details.

- Ask the support team for the percentage of assets kept in cold storage.

- Confirm whether the exchange holds any insurance policy for custodial assets.

- Start with a small test deposit (e.g., $100) and observe withdrawal speed and any unexpected fees.

If any of the above items raise red flags, consider using a more established platform for the bulk of your trading activity.

Bottom Line

Neraex can serve as a low‑fee entry point for casual traders who want to dip their toes into crypto without moving large sums. Its presence on CoinGecko adds a sprinkle of legitimacy, but the lack of public security audits, unclear regulatory status, and thin liquidity put it behind the industry leaders.

For anyone who values strong insurance, audited cold storage, and robust compliance, sticking with Binance, Coinbase, or Kraken is the safer bet. Use Neraex only after thorough personal vetting and never store more than you’re willing to lose.

Frequently Asked Questions

Is Neraex regulated in any jurisdiction?

Neraex states it follows AML and KYC procedures, but it does not publish a specific licensing authority or registration number. Without a clear regulator, it should be considered unregulated for most users.

What security measures does Neraex actually provide?

The exchange offers HTTPS encryption, optional 2FA/MFA, and withdrawal whitelisting. It does not disclose cold‑storage ratios, third‑party audit results, or a bug‑bounty program, which are common on larger exchanges.

How do the fees on Neraex compare to other exchanges?

Neraex charges 0.15% maker and 0.25% taker, which is cheaper than Coinbase’s 0.50% taker fee but higher than Binance’s 0.02%‑0.10% tiered fees for high‑volume traders.

Is there any insurance coverage for assets stored on Neraex?

The platform does not publicly disclose any insurance policy. In contrast, Coinbase and Binance both list insurance limits for custodial crypto holdings.

Can I use Neraex on my mobile device?

Yes, Neraex offers iOS and Android apps that mirror the web UI. The apps lack advanced charting tools but support basic spot trading and portfolio view.

Jacob Anderson

January 1, 2025 AT 02:07Oh great, another exchange with "competitive" fees but the trading volume is about the size of my coffee budget. Sure, 0.25% taker sounds nice until you realize you’ll probably pay that fee on a slippage‑induced price swing because the order book is as thin as tissue paper. The lack of third‑party audits is just the cherry on top of this high‑risk sundae. If you enjoy living on the edge, Neraex might be your playground; otherwise, stick to the giants.

Katrinka Scribner

January 2, 2025 AT 05:53Hey folks 😊 I just tried Neraex and wow, the UI is super clean! I love the 2FA option, but I wish they had a proper audit report somewhere. The fees look cool, but with only $12M volume you might get stuck on the spread. Anyway, happy to share my tiny test deposit experience! 😄

VICKIE MALBRUE

January 3, 2025 AT 09:40Sounds like a decent option for tiny trades!

april harper

January 4, 2025 AT 13:27In the grand theatre of crypto, Neraex steps onto the stage with a modest spotlight, its curtains drawn over a meager volume that whispers rather than shouts. The audience, yearning for security, finds only the barebones of HTTPS and 2FA, leaving the shadows of cold storage untouched. One might argue that the fee structure is a tempting siren song, yet the underlying foundations tremble like a house of cards in a windstorm. Without the reassuring hand of a regulator, the performance feels precarious. Thus, the exchange dances on the thin line between opportunity and peril.

Kate Nicholls

January 5, 2025 AT 17:13The fee schedule does look attractive at first glance, especially compared to Coinbase's taker rates, but when you factor in the limited liquidity, the effective cost can balloon quickly. Security-wise, the absence of public audits is a red flag, and the vague regulatory status only adds to the uncertainty. If you're a casual trader dipping your toe in, you might get away with it, but for any substantial holdings it's a gamble worth reconsidering. In short, lower fees don’t automatically equal lower risk.

Michael Wilkinson

January 6, 2025 AT 21:00Listen up, anyone who thinks they can ignore the glaring red flags on Neraex is kidding themselves. No transparent audit, ambiguous licensing, and a pitiful $12M daily volume-this is not a platform for serious investors. Stop treating it like a hidden gem and recognize it for what it is: a high‑risk sandbox. If you value your capital, move on to exchanges with proven security and regulatory compliance.

Clint Barnett

January 8, 2025 AT 00:47Alright, buckle up because we’re about to take a deep dive into the ocean that is Neraex, and trust me, there are more currents here than you’d expect in a kiddie pool. First off, the fee structure-0.15% maker and 0.25% taker-might look like a bargain, especially if you’re coming from a place where Binance whispers sweet nothings about tiered discounts, but remember that fees are only one side of the coin; liquidity is the other, and Neraex’s $12 million daily volume is more akin to a trickle than a torrent. When you try to execute a trade larger than a few thousand dollars, you’ll likely see the market price move against you, a phenomenon we in the community affectionately call “slippage,” and that can erode any savings from the lower fees faster than you can say “order book depth.” Now, let’s talk security. The platform boasts HTTPS, 2FA, and even optional MFA, which is a nice baseline, but the devil is in the details-how much of your crypto actually sits in cold storage? How often do they subject themselves to third‑party penetration tests? The answer, unfortunately, is a resounding silence, and in the world of digital assets, silence is rarely a virtue. Without publicly available audit reports or a bug‑bounty program, you’re essentially handing over your keys to a locksmith who never shows you the lock. Regulation, dear reader, is another jagged stone on this path. Neraex claims to follow AML and KYC procedures, yet nowhere does it flash a licensing number from a recognized authority, unlike Coinbase's gleaming licenses scattered across fifty U.S. states. This opacity makes it difficult for a regular investor to gauge the legal protections-or lack thereof-should something go awry. On the plus side, the user interface is clean, the mobile apps function without any major hiccups, and the support ticket system, though slow, eventually gets you a response. If you’re a hobbyist looking to experiment with a tiny fraction of your portfolio, you might find Neraex a convenient sandbox. However, for anyone holding more than a modest amount, the risk-reward calculus leans heavily toward the “stay away” side. In summary, treat Neraex as a curiosity rather than a safe haven, and never allocate more capital than you’re prepared to lose. Happy trading, and may your passwords be strong and your cold storage be truly cold.

Lindsay Miller

January 9, 2025 AT 04:33I get why the clean UI and low fees catch your eye, but the lack of clear security audits can feel unsettling. It’s always a good idea to start with a tiny test deposit, watch how withdrawals work, and only then decide if you want to keep more funds there. Staying cautious helps protect your peace of mind.

Jason Brittin

January 10, 2025 AT 08:20Wow, Neraex really nailed the “look good, feel risky” combo 😂. If you enjoy watching your order slip through a thin book, this is the place.

Naomi Snelling

January 11, 2025 AT 12:07Honestly, the whole “no audit” thing feels like a cover-up. Who knows what hidden code they might be running behind that sleek interface? Better keep an eye out for any sudden freezes.

MD Razu

January 12, 2025 AT 15:53When we peer into the abyss that is Neraex, we are forced to confront the very nature of trust in the digital age, a subject that has occupied philosophers since the inception of the ledger itself. The exchange touts a 0.15% maker fee as if it were a golden ticket, yet neglects to mention the silken threads of liquidity that barely hold the market together. One must ask: does the fee truly matter when the order book is as shallow as a dried riverbed, causing each trade to ripple in unpredictable ways? The absence of third‑party audits is not a mere omission; it is a void where accountability should reside, and in that void lurks the possibility of undisclosed vulnerabilities. Consider the regulatory landscape, or rather the fog that shrouds it. Without a visible license or a recognized supervisory body, the exchange operates in a legal gray zone, inviting speculation about the safeguards-or lack thereof-governing user funds. The KYC process they claim to enforce may be a superficial gate rather than a robust barrier against illicit activity, a notion that should raise alarm bells for any prudent investor. Moreover, the so‑called “MFA optional” feature, while sounding reassuring, becomes a hollow promise if the underlying architecture does not enforce it by default. Security, in the realm of cryptocurrency, is not merely a checklist of 2FA and HTTPS; it is a tapestry woven from cold storage ratios, multi‑sig wallets, and continuous penetration testing. Neraex’s silence on these critical components is tantamount to a ship sailing without a compass, trusting merely on good winds to reach shore. The risk of a single breach, unmitigated by insurance or audit verification, could decimate holdings far beyond the modest fees saved. In the grander scheme, the platform’s modest $12 million daily volume positions it as a minor player, vulnerable to market manipulation and price volatility that larger exchanges can absorb. If you place a substantial order, you may find the market moving against you as if the exchange itself were a puppet master pulling strings. Therefore, the rational path is clear: treat Neraex as an experimental sandbox, limiting exposure to an amount you can comfortably part with. Do not gamble your core portfolio on an exchange that refuses to lay its cards on the table, and always maintain a diversified strategy that protects against the inherent uncertainties of this space.

Waynne Kilian

January 13, 2025 AT 19:40i totally see both sides here-on one hand the low fees are appealing, on the other the lack of audit is scary. maybe we can all agree to test it with a tiny amount and share our experiences, that way we learn together without risking too much.