When you search for Tsunami crypto exchange, you’re not looking at one platform-you’re looking at two completely different things. One is a shady centralized service with a history of delays and lost money. The other is a multi-chain decentralized exchange trying to carve out space in a crowded market. Confusing? You bet. But knowing the difference could save you from losing cash-or worse, your crypto.

Two Platforms, One Name: The Tsunami.cash Problem

Tsunami.cash is a centralized exchange that acts like a middleman. You send them fiat or crypto, they convert it, and send it back. Sounds simple, right? Except users keep reporting the same nightmare: you lock in a rate, start the transaction, and while you wait 20 to 45 minutes for confirmation, the market moves. When your crypto finally arrives, you’re stuck with less than you expected. According to BestChange.com reviews from July 2024 to October 2025, 67% of users who reported issues said they lost money because of these delays. One user, Viacheslav, described how the official rate jumped 5% while his transaction was pending. He paid more for the same amount of Bitcoin because the system didn’t lock the rate until it was too late. There’s no API, no mobile app, no transparency. No one knows where Tsunami.cash is legally registered. No licensing info. No official headquarters. And their support? When users complained, the replies were generic: “It’s taking extra time for verification.” No timeline. No fix. Just silence. Industry watchdogs aren’t ignoring this. The SEC targeted 78% of unregistered exchanges in Q3 2025. Tsunami.cash fits the profile: offshore, no KYC clarity, delayed processing that looks like intentional rate manipulation. CoinMarketCap doesn’t list it. No reputable exchange aggregator includes it. If you’re looking for safety, this isn’t it.Tsunami.exchange: The Decentralized Alternative

Now, Tsunami.exchange is a totally different animal. It’s a decentralized exchange (DEX) built to work across Cardano, Ethereum, and Solana. No middleman. No waiting for a company to process your trade. You connect your wallet-MetaMask, Phantom, Ledger-and swap directly on-chain. It supports 12+ wallets and integrates with tools like Serum DEX, Solong, and Waves. That’s rare. Most DEXs stick to one chain. Raydium? Solana-only. Uniswap? Ethereum-focused. Tsunami.exchange tries to bridge the gap. If you hold Cardano ADA and want to swap it for SOL without going through a centralized exchange, this is one of the few places that lets you do it directly. The platform uses a governance token called TSN. Holders can vote on protocol upgrades, fee structures, and new chain integrations. That’s a sign of real decentralization-not just a buzzword. It’s not perfect, but it’s built like a protocol, not a storefront. Here’s the catch: liquidity. As of September 2025, Tsunami.exchange doesn’t publish trading volume. That’s a red flag. Uniswap moved $18.7 billion that same month. Tsunami.exchange? Nobody knows. The top five DEXs control 82% of the $24.7 billion monthly DEX volume. Tsunami.exchange is still tiny.Why Tsunami.exchange Isn’t Easy to Use

You can’t just sign up and trade like on Binance. Tsunami.exchange requires you to understand wallets, networks, gas fees, and cross-chain bridges. If you’ve never used MetaMask or connected a wallet to a DEX, you’ll hit walls. SourceForge’s September 2025 review called its interface “accessible for experienced users” but admitted the learning curve is “moderate.” That’s polite for “you’ll probably mess up your first swap.” You need to know:- Which network your token is on (ERC-20? SPL? BEP-20?)

- How to switch networks in your wallet

- What gas fees look like on Solana vs Ethereum

- When to use a bridge vs a native swap

Fee Comparison: What You’re Really Paying

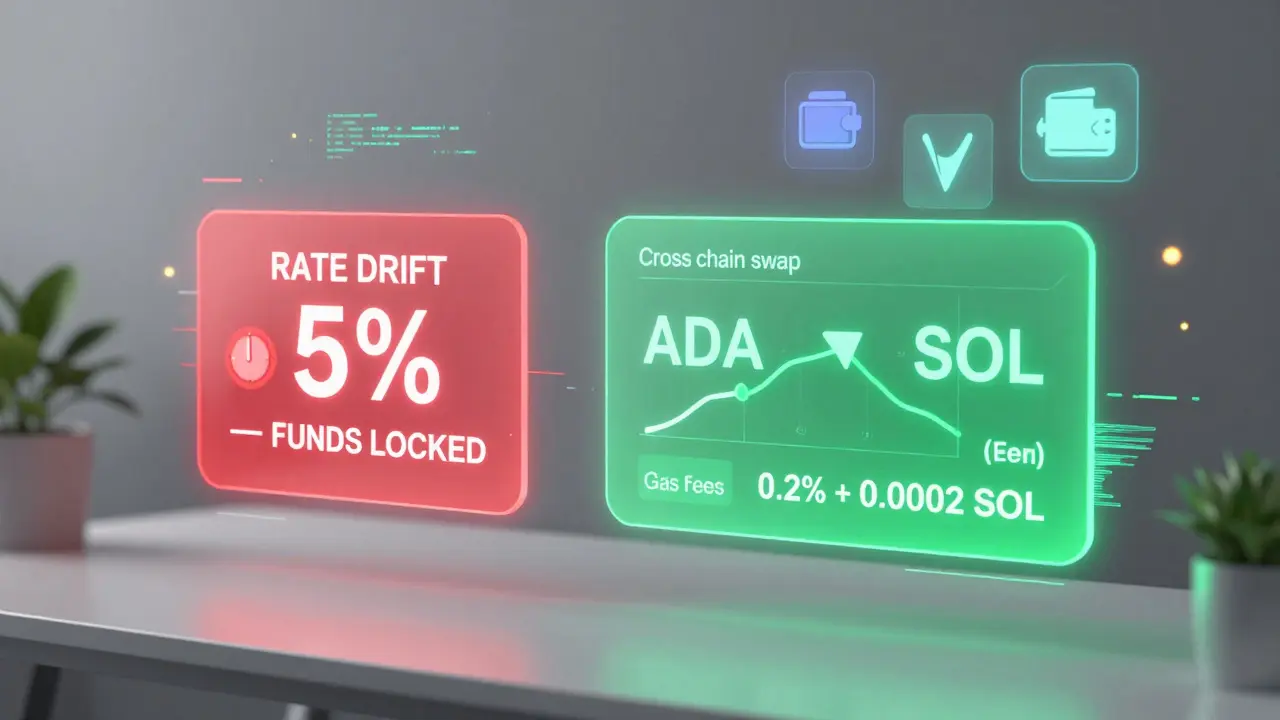

Tsunami.cash hides its fees. You see a rate, click “exchange,” and then get hit with an unexpected 3-7% increase because of processing delays. That’s not a fee-it’s a loss caused by poor system design. Tsunami.exchange doesn’t list fees on its website either. But here’s how it works: you pay network gas fees (paid in the native token of the chain you’re using) and a small protocol fee (usually 0.1%-0.3%) that goes to liquidity providers. No hidden markups. No rate manipulation. For example:- Swapping ADA to SOL on Tsunami.exchange: 0.2% protocol fee + 0.0002 SOL gas

- Swapping $500 BTC to USDT on Tsunami.cash: 5% hidden loss due to rate drift during 30-minute delay

Who Should Use Which Platform?

Don’t use Tsunami.cash if:- You’re holding any significant amount of crypto

- You care about getting the rate you see

- You want to avoid regulatory risk

- You’ve heard stories of people losing money on it

- You’re comfortable with wallets and DeFi

- You trade across Cardano, Solana, or Ethereum

- You want to avoid centralized custody

- You’re okay with low liquidity for now

The Bigger Picture: Why This Matters

The crypto market is splitting into two paths: centralized services that feel like banks but act like gambling dens, and decentralized protocols that feel like open-source software but require technical skill. Tsunami.cash represents the old model: opaque, slow, and designed to profit from user ignorance. It’s the kind of platform that gets shut down by regulators next year. Tsunami.exchange represents the future-but it’s still early. It’s like trying to use a Tesla in 2008. The tech is brilliant. The infrastructure is weak. The user base is small. But if it survives the next 12 months, it could be part of the next wave of multi-chain DeFi. Right now, the market is flooded with new DEXs. The “Crypto ETF Tsunami” has brought institutional money into blockchain, but not necessarily into small protocols. Tsunami.exchange needs liquidity, partnerships, and a clear roadmap. So far, it has none of those publicly.Final Verdict: Avoid One, Test the Other Cautiously

Tsunami.cash is a trap. Walk away. Don’t even think about depositing funds. The delays, the lack of transparency, the regulatory red flags-they’re not accidental. They’re the business model. Tsunami.exchange? It’s a gamble. Not a scam. But not a safe bet either. If you’re experienced, have small amounts to test with, and want to explore cross-chain swaps without a centralized exchange, give it a try. Use a wallet with only a few dollars. See how it works. Learn the steps. Then decide. Don’t trust the name. Don’t trust the branding. Look at the tech. Look at the history. Look at the users. The real tsunami isn’t coming-it’s already here. And the ones who survive aren’t the ones who jumped on the hype. They’re the ones who understood the currents.Is Tsunami.cash safe to use?

No, Tsunami.cash is not safe. Multiple users report losing money due to delayed transactions where exchange rates shift during processing. The platform has no transparent fee structure, no official licensing, and no public technical documentation. BestChange.com and industry analysts have flagged it as suspicious and untrustworthy. Avoid depositing any funds.

What’s the difference between Tsunami.cash and Tsunami.exchange?

Tsunami.cash is a centralized exchange that acts as a middleman-you send money to them, they convert it, and send it back. Tsunami.exchange is a decentralized exchange (DEX) that lets you swap crypto directly on-chain using your own wallet. Tsunami.cash has hidden fees and delays; Tsunami.exchange has transparent gas fees but requires technical knowledge. They’re completely different platforms with no shared ownership.

Does Tsunami.exchange support Bitcoin and Ethereum?

Tsunami.exchange supports Ethereum (ERC-20 tokens) and Solana (SPL tokens), as well as Cardano (ADA). It does not directly support Bitcoin (BTC) because BTC isn’t natively compatible with its multi-chain architecture. To swap BTC, you’d need to first convert it to wrapped BTC (wBTC) on Ethereum or another compatible chain. Always check token compatibility before sending.

Is Tsunami.exchange better than Uniswap or Raydium?

Not yet. Uniswap and Raydium have far higher liquidity, proven track records, and larger user bases. Tsunami.exchange’s advantage is multi-chain support-it works across Cardano, Ethereum, and Solana, while Raydium is Solana-only and Uniswap is Ethereum-only. But if you need to swap large amounts, stick with Uniswap or PancakeSwap. Tsunami.exchange is better for small, cross-chain experiments.

Can I use Tsunami.exchange on my phone?

Yes. Tsunami.exchange has web, mobile (iOS and Android), and desktop (Windows, Mac, Linux) support. You access it through your wallet app like MetaMask or Phantom, not through a standalone app. Make sure your wallet is updated and connected to the correct blockchain network before trading.

What happens if Tsunami.exchange shuts down?

If Tsunami.exchange shuts down, your crypto won’t disappear. Since it’s a decentralized exchange, your funds are always in your own wallet-not held by the platform. You can still access them using your private key or seed phrase. The only thing you lose is the interface to swap tokens. You’d need to find another DEX that supports the same chains.

Are there any alternatives to Tsunami.exchange?

Yes. For cross-chain swaps, try Thorchain or Multichain.org. For Ethereum, use Uniswap. For Solana, use Raydium or Orca. For Cardano, use Minswap or WingRiders. These platforms have higher liquidity, better documentation, and longer track records. Tsunami.exchange is an experimental option, not a replacement.

Natalie Kershaw

January 7, 2026 AT 02:42Okay but can we talk about how Tsunami.cash is basically a crypto phishing site with a fancy logo? I lost $800 last year thinking I was getting a good rate, only to find out my transaction was stuck for 47 minutes while the market dropped 6%. No API, no transparency, no accountability. It’s not a glitch-it’s a feature. Don’t even open your wallet near that thing.

Meanwhile, Tsunami.exchange? I’ve swapped ADA to SOL three times now. Gas fees are predictable, no rate slippage, and I actually feel like I’m part of the protocol because of TSN voting. It’s clunky, yeah-but at least it’s not stealing from me.

TL;DR: Tsunami.cash = scam. Tsunami.exchange = future, if you’re willing to learn.

Mujibur Rahman

January 8, 2026 AT 05:00Look I’ve been in this space since 2017 and let me tell you something-Tsunami.cash isn’t just shady it’s a regulatory time bomb waiting to explode. SEC’s been tracking unregistered exchanges like this since Q1 2025 and they’re coming for the low-hanging fruit. You think you’re saving time by using a middleman? Nah you’re just handing your keys to a guy in a basement who doesn’t even have a business license.

Tsunami.exchange on the other hand? It’s not perfect but it’s open source. You can audit the contracts. You can see the liquidity pools. You can vote on upgrades. That’s not a DEX that’s a DAO with a UI. Most people don’t get it because they want to click and go but crypto ain’t Amazon. If you don’t know what a bridge is you shouldn’t be trading-but that’s on you not the platform.

Stop blaming the tech for your laziness.

Jennah Grant

January 9, 2026 AT 22:08I used Tsunami.exchange last week to swap some ETH for SOL and honestly it was terrifying but also kind of empowering. I messed up the network switch once and sent a test transaction to the wrong chain-lost 0.0005 ETH but learned more in 10 minutes than I did in 6 months of watching YouTube tutorials.

It’s not for beginners. But if you’re willing to learn, it’s one of the few places that actually lets you own your assets without relying on some offshore company that disappears if the Feds knock on their door. Tsunami.cash? That’s not crypto. That’s a forex broker pretending to be Web3.

Mollie Williams

January 9, 2026 AT 22:13There’s something poetic about how the same name carries two opposing truths-one a mirror of the old financial world’s opacity, the other a fragile attempt at radical transparency. Tsunami.cash thrives on ignorance. Tsunami.exchange demands understanding.

We live in an age where convenience is worshipped above sovereignty. People will trade their autonomy for a 30-second swap, then cry when their funds vanish. But those who learn to navigate the chaos-not by avoiding it, but by mastering it-are the ones who’ll still be standing when the tide recedes.

Maybe the real tsunami isn’t the market. Maybe it’s the awakening.

And maybe we’re all just trying to swim before the water rises too high.

Surendra Chopde

January 11, 2026 AT 05:59Bro I tried Tsunami.exchange last month and it was a nightmare. I had to use Phantom wallet, switch to Solana network, then use the bridge for Cardano-forgot to check token decimals and sent 2 ADA to the wrong contract. Lost $15. No refund. No support. Just a blockchain error.

Tsunami.cash? At least they reply to emails. Sometimes. Not fast. But they reply. I’d rather pay 5% hidden fee than lose my coins forever because I clicked wrong button. Tech is cool but not if it eats your money.

Tre Smith

January 11, 2026 AT 16:48Let’s be brutally honest. Tsunami.exchange is a prototype. It’s not even beta-it’s alpha with a marketing budget. No published volume? No team bios? No whitepaper update since 2023? That’s not innovation, that’s vaporware. You think you’re supporting decentralization but you’re just funding a side project run by three devs who haven’t slept since last summer.

Tsunami.cash? At least they have a website that loads. At least they have a support ticket system. At least they’re not pretending to be something they’re not. If you want real DeFi, use Uniswap. If you want to gamble on a GitHub repo with a cool name, go ahead. But don’t act like you’re a pioneer when you’re just a beta tester with a wallet full of regret.

Rahul Sharma

January 12, 2026 AT 04:47Dear friends, I would like to respectfully suggest that the comparison between Tsunami.cash and Tsunami.exchange is not entirely fair, as one is a centralized service and the other is a decentralized protocol. The former operates under the traditional financial model of trust-based intermediation, whereas the latter operates under the cryptographic model of trustless execution.

Therefore, the risk profiles are fundamentally different. Tsunami.cash exposes users to counterparty risk, operational risk, and regulatory risk. Tsunami.exchange exposes users to technical risk, liquidity risk, and user error risk.

It is not a matter of which is better, but which risk one is willing to bear. For institutional investors, Tsunami.cash is dangerous. For self-custodial users with technical literacy, Tsunami.exchange is a valuable tool.

Always conduct your own research. Always verify contracts. Always test with small amounts.

Krista Hoefle

January 13, 2026 AT 13:42tbh i just googled tsunami crypto and clicked the first link. now my ada is gone. whoops. guess i’m not smart enough for web3. maybe i should’ve just kept it in binance. lol. anyway tsunamii.exchange looks like a scam too. all these dexes look the same. why do they all have like 3 buttons and a loading spinner for 10 minutes? 🤡

Kip Metcalf

January 14, 2026 AT 15:43Man I was scared to even try Tsunami.exchange after reading all the horror stories. But I put $20 in, swapped ADA to SOL, and it worked. No drama. No delays. Just gas fees and a little learning curve. I didn’t lose anything. I didn’t get scammed. I just… did it.

Maybe the real problem isn’t the tech. Maybe it’s that we’re still waiting for someone to hold our hand through crypto. But no one’s coming. You gotta jump.

And if you’re scared? Start with $5. Not $500. Not $5k. Five bucks. See how it feels. Then decide.

Frank Heili

January 15, 2026 AT 22:28For anyone considering Tsunami.exchange, here’s the real checklist: 1) Do you know how to switch networks in your wallet? 2) Do you know what gas fees are on each chain? 3) Do you have a backup seed phrase stored offline? 4) Have you tested a tiny transaction before going big? If you answered no to any of those, don’t touch it.

But if you said yes? You’re already ahead of 90% of crypto users. Tsunami.exchange isn’t the easiest DEX-but it’s one of the few that doesn’t treat you like a cash cow. It treats you like a participant. That’s worth something.

Also, TSN token voting? That’s rare. Most DEXs just take your fees and disappear. This one lets you shape the future. That’s not just tech-that’s democracy.

Jacob Clark

January 17, 2026 AT 05:39Okay so I’ve been waiting for someone to call this out and I’m so glad this post did. Tsunami.cash is literally the worst. I had a friend who lost $12K because the site said ‘rate locked’ but didn’t lock it. Then they blocked his account and said ‘we’re under maintenance.’ Maintenance for 3 weeks? What kind of scam is this?!

And Tsunami.exchange? It’s not perfect but at least it doesn’t lie. No fake ‘rate locked’ banners. No hidden fees. Just cold hard blockchain truth. I’ve used it for 6 months now. I’ve made mistakes. I’ve lost small amounts. But I’ve never been robbed. That’s the difference.

And if you think I’m overreacting-go check the BestChange reviews. 67% of users lost money. That’s not a bug. That’s a business plan.

Jon Martín

January 17, 2026 AT 18:33THIS IS WHY WE NEED MORE EDUCATION IN CRYPTO

People don’t understand that Tsunami.cash isn’t a platform-it’s a trapdoor. And Tsunami.exchange isn’t a tool-it’s a doorway to the future. One is designed to take your money. The other is designed to teach you how to keep it.

I’ve seen so many newbies get crushed because they think crypto is about ‘getting rich quick.’ It’s not. It’s about sovereignty. It’s about control. It’s about knowing what you own and how it moves.

Tsunami.exchange is hard because freedom is hard. But it’s worth it.

Stop looking for hand-holding. Start learning. The blockchain doesn’t care if you’re scared. But it rewards those who show up anyway.

Dennis Mbuthia

January 19, 2026 AT 08:52Look I don’t care if Tsunami.exchange is ‘decentralized’-if it’s not on Coinbase or Binance it’s not real. You think some indie dev in a garage with a GitHub repo is gonna outlast the big boys? Please. The US government is coming for these little DEXs. They’re gonna shut them down faster than you can say ‘Ethereum gas fee.’

Tsunami.cash? At least it’s legit in the sense that it’s a business. It’s not trying to be a revolution. It’s trying to make money. And guess what? So am I. I’m not gonna risk my life savings on some ‘open-source protocol’ that might vanish tomorrow. I want a company with a phone number. A real address. A CEO. Not a pseudonym on Discord.

Don’t be a crypto bro. Be smart. Use a regulated exchange. End of story.

Becky Chenier

January 21, 2026 AT 07:17I think both platforms have their place. Tsunami.cash appeals to people who aren’t ready for DeFi. Tsunami.exchange appeals to those who are. Neither is perfect. But one is honest about its limitations. The other hides behind vague terms like ‘processing time.’

I used Tsunami.cash once. I’ll never use it again. I used Tsunami.exchange twice. I’ll use it again-once I learn how to use bridges properly.

It’s not about which is better. It’s about which matches your level of understanding. And if you’re not sure? Start small. Test. Learn. Then decide.