MFSA License Eligibility Checker

Determine if your crypto business needs an MFSA license in Malta based on your specific activities. This tool helps you identify whether you fall under the regulated services requiring authorization from the Malta Financial Services Authority.

Result

Next Steps

Malta’s crypto rules aren’t just another set of guidelines-they’re one of the most advanced, well-tested frameworks in Europe. If you’re thinking about launching a crypto business, listing a token, or even just operating in the space, understanding the Malta Financial Services Authority (MFSA) rules isn’t optional. It’s the difference between getting licensed and getting shut down.

What Changed in November 2024?

Before 2024, Malta had its own crypto law: the Virtual Financial Assets Act (VFAA), passed in 2018. It made Malta one of the first countries to try and regulate crypto seriously. But in November 2024, everything shifted. The EU’s Markets in Crypto-Assets Regulation (MiCA) became law across all member states. Malta didn’t just follow it-they rewrote their own law to match it exactly, creating the Markets in Crypto-Assets Act (Chapter 647). This new law replaced the VFAA. That means if you’re operating under old VFAA licenses, you had to transition to MiCA-compliant status by mid-2025.Who Needs a License from the MFSA?

The MFSA doesn’t regulate all crypto activity. Only specific players need formal authorization:- Crypto-Asset Service Providers (CASPs)-this includes exchanges, wallet providers, custody services, and brokers.

- Issuers of Asset-Referenced Tokens (ARTs)-tokens tied to the value of real assets like fiat currencies, commodities, or other crypto.

- Issuers of Electronic Money Tokens (EMTs)-digital tokens meant to act like electronic cash, often used for payments.

- Issuers of other crypto-assets-like utility tokens or governance tokens that don’t fall into ART or EMT categories.

The MiCA Rulebook: Your Compliance Bible

The law alone isn’t enough. In March 2025, the MFSA published the MiCA Rulebook-a 300+ page document that breaks down exactly what compliance looks like day to day. It’s split into four key parts:- Title 2: How to apply for authorization. This includes submitting a detailed whitepaper for token offerings, proving your team’s experience, and showing you have enough capital to cover risks.

- Title 3: Ongoing rules for CASPs. You must have clear conflict-of-interest policies, client asset segregation, cybersecurity controls, and transaction monitoring systems.

- Title 4: Rules for ART issuers. These are high-risk because they’re tied to real assets. You need regular audits, reserve verification, and strict transparency on how the token’s value is maintained.

- Title 5: Enforcement and appeals. If the MFSA denies your application or revokes your license, you have the right to appeal-but you need strong legal backing.

Whitepapers Aren’t Optional-They’re Mandatory

If you’re issuing a crypto-token in Malta, you must publish a whitepaper and submit it to the MFSA before launch. This isn’t a marketing brochure. It’s a legal document that must include:- Exact description of the token’s function and use case

- Technical architecture (blockchain, consensus mechanism)

- Tokenomics: supply, distribution, vesting schedules

- How the issuer plans to maintain value (for ARTs)

- Risks to investors

- Details of the team and their qualifications

How Much Does It Cost to Get Licensed?

Malta’s fees are transparent and tied to your business size and risk level. The Markets in Crypto-Assets Act (Fees) Regulations, 2024 set clear rates:- CASP application fee: €10,000-€35,000 depending on services offered and expected transaction volume.

- Annual supervision fee: €5,000-€50,000+ based on asset under management and number of clients.

- ART issuer fee: €25,000 application + €15,000-€75,000 annual fee (higher due to systemic risk).

- EMT issuer fee: Follows financial institution fee rules under the Financial Institutions Act.

Anti-Money Laundering: The Hidden Layer

Even if you’re licensed by the MFSA, you’re still under the watch of another agency: the Financial Intelligence Analysis Unit (FIAU). They enforce strict AML rules that apply to every crypto business in Malta. You must:- Verify every customer’s identity (KYC)

- Monitor transactions for suspicious patterns

- Report any unusual activity within 48 hours

- Keep records for at least five years

Workshops, Not Just Rules

What sets Malta apart isn’t just the rules-it’s how the MFSA helps you follow them. In June 2025, they held a major workshop called “Building a Compliant Crypto Future.” Over 120 firms attended. The speakers weren’t lawyers-they were MFSA supervisors: Sarah Pulis, Pauline Tonna, and Antonio Battaglino. They walked through real cases: how they spotted conflicts of interest, why some whitepapers got rejected, and what red flags they look for in custody setups. This isn’t a one-off. The MFSA holds quarterly workshops, publishes guidance documents, and even responds to direct queries from licensed firms. They don’t wait for violations-they try to prevent them.

Why Malta Still Leads in Crypto Regulation

Most EU countries are just starting to implement MiCA. Malta’s been doing this since 2018. That six-year head start matters. - Maltese firms already had experience submitting whitepapers, managing client assets, and dealing with audits. - The MFSA’s staff have handled hundreds of applications and investigations. - The legal framework is battle-tested. Courts have already ruled on crypto disputes under the VFAA. That means if you’re applying for a license in Malta today, you’re working with regulators who’ve seen it all. They know what works-and what blows up.What’s the Catch?

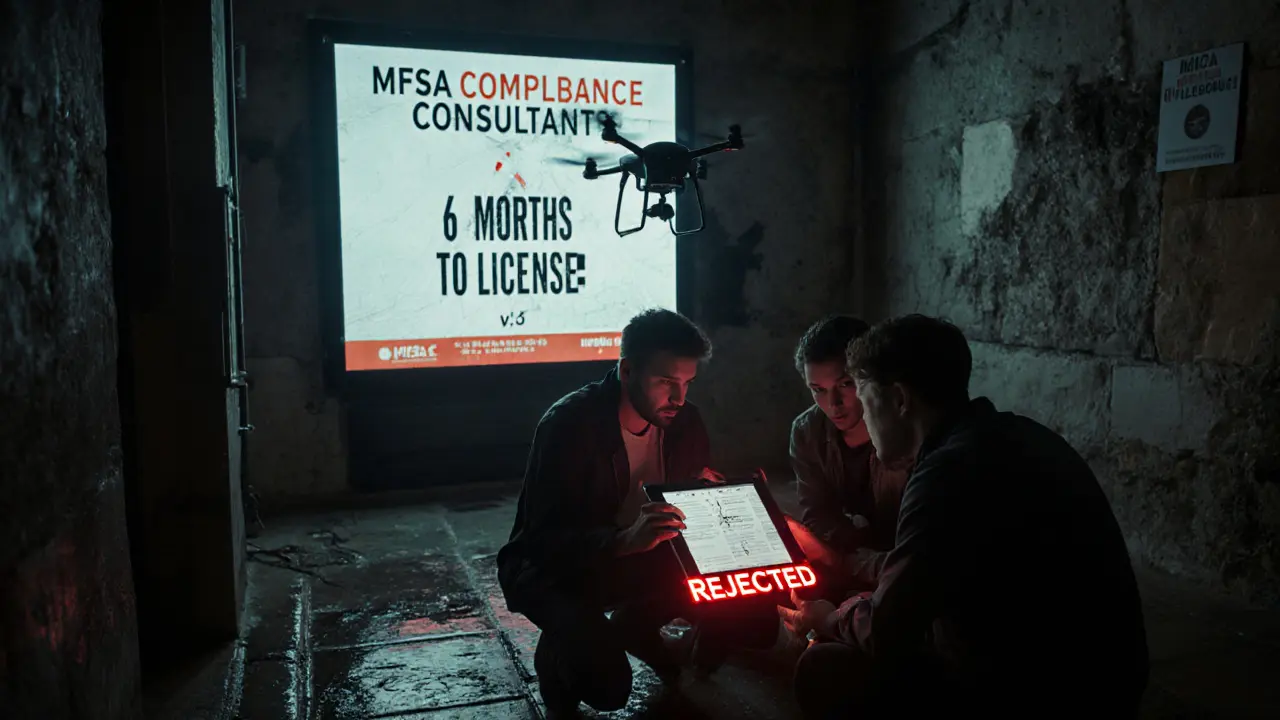

It’s not all smooth sailing. The complexity is real. You’re not just dealing with Malta’s rules-you’re juggling EU-wide MiCA standards, national laws, and FIAU AML rules. One misstep in your KYC process could trigger an investigation from both agencies. Many small teams get overwhelmed. One startup founder told us they spent six months just trying to understand whether their token was an ART or a utility token. The difference changed their entire licensing path. You need legal counsel who’s done this before. Generic crypto lawyers won’t cut it. You need someone who’s read the MiCA Rulebook cover to cover and has worked with the MFSA on actual applications.Who Should Avoid Malta’s System?

If you’re:- A solo developer launching a meme coin with no real use case

- Looking for a quick, low-cost license

- Unwilling to spend €100,000+ on compliance

- Expecting fast approvals (the process takes 6-12 months)

What’s Next?

The MFSA says MiCA is just the beginning. In August 2025, they released a report called “Changing Dynamics of Crypto Regulation 2025,” hinting at future rules around decentralized finance (DeFi), AI-driven trading bots, and stablecoin reserve transparency. They’re not slowing down. If you’re in crypto and want to operate in Europe, Malta’s framework is the gold standard. It’s expensive. It’s strict. But it’s the only one that actually works.Do I need a license if I only trade crypto for myself in Malta?

No. Personal trading or holding crypto for your own portfolio doesn’t require an MFSA license. The rules only apply to businesses offering services to others-like exchanges, custody providers, or token issuers.

How long does it take to get licensed by the MFSA?

It typically takes 6 to 12 months, depending on the complexity of your business. Issuers of asset-referenced tokens face longer reviews due to higher risk. The MFSA may request additional documentation, which can extend the timeline. Starting with a well-prepared whitepaper and clean compliance setup can speed things up.

Can I use a crypto license from another EU country in Malta?

No. While MiCA allows for passporting across the EU, you still need to apply through the MFSA if you want to operate in Malta. The MFSA must review your application and confirm compliance with both MiCA and Malta’s national rules. You can’t just transfer a license from Germany or France.

What happens if I don’t get licensed and operate anyway?

Operating without a license is illegal under Malta’s Markets in Crypto-Assets Act. Penalties include fines up to €5 million, criminal charges against directors, and forced shutdown of operations. The MFSA can also freeze assets and block payment processing. Many firms have been shut down since 2024 for operating without authorization.

Are stablecoins regulated differently in Malta?

Yes. Stablecoins tied to fiat currencies (like EUR or USD) are classified as Electronic Money Tokens (EMTs) and fall under both MiCA and the Financial Institutions Act. They require stricter reserve audits, daily transparency reports, and additional capital buffers. Stablecoins backed by other crypto assets are treated as Asset-Referenced Tokens (ARTs) and face different, but still strict, requirements.

Becky Shea Cafouros

November 14, 2025 AT 11:33So basically Malta turned into the crypto DMV. Six months just to get approved? And you need a lawyer just to read the whitepaper requirements? I get it’s regulated, but this feels like paying for a gym membership you’ll never use.

sandeep honey

November 14, 2025 AT 18:54Why is everyone acting like this is new? India’s been cracking down on crypto for years but at least we didn’t build a 300-page rulebook just to say we tried. This is overengineering for prestige.

Mandy Hunt

November 15, 2025 AT 13:31They say MiCA is the gold standard but who really controls the MFSA? Big finance. They made these rules so only banks and hedge funds can play. Small devs get crushed. You think this is about consumer protection? Nah. It’s about control. They’ll shut you down before you even launch

anthony silva

November 17, 2025 AT 02:17€150K just to apply? Bro I made a meme coin last week and it hit 200k market cap. Why am I paying lawyers when I could just pump and dump?

Sara Lindsey

November 17, 2025 AT 14:02Malta’s actually doing something right here. Not perfect but they’re trying. Most places just ignore crypto until it blows up. This is proactive not reactive. If you’re serious this is the place to be

alex piner

November 19, 2025 AT 12:49Im kinda new to this but i read this and it made sense. Like i get it now why people say malta is legit. Not easy but at least its clear. Thx for the breakdown

Gavin Jones

November 19, 2025 AT 13:38It’s refreshing to see a regulator that engages with the community rather than just issuing fines. The workshops, the transparency, the willingness to guide-this is how regulation should be done. Other jurisdictions should take notes.

Mauricio Picirillo

November 20, 2025 AT 03:18Man I’ve seen so many startups fold trying to navigate this. One guy I know spent 9 months on his whitepaper and got rejected because he said ‘decentralized’ too many times. The MFSA doesn’t care about buzzwords-they want clarity. Respect.

Liz Watson

November 20, 2025 AT 11:51Oh wow Malta’s the gold standard? Tell that to the 47 crypto firms that got fined last year for using the word ‘guarantee’ in their marketing. This isn’t regulation-it’s a trap for the naive.

Rachel Anderson

November 22, 2025 AT 02:22I read the MiCA Rulebook. It’s 300 pages of legal jargon dressed up as ‘guidance’. The MFSA didn’t create a framework-they created a maze. And they’re the only ones with the map.

Kevin Hayes

November 22, 2025 AT 14:58Regulation isn’t about stifling innovation-it’s about creating a stable environment where innovation can survive long-term. Malta’s system filters out the fluff. The people complaining? They weren’t building anything sustainable anyway. The market will reward the ones who play by the rules.

ratheesh chandran

November 23, 2025 AT 17:12you know what i think? this whole thing is just a way for the elite to keep the little guys out. they want us to pay 50k just to say we exist. but who really benefits? the banks. always the banks. its not about security its about power

Hannah Kleyn

November 24, 2025 AT 05:42I’ve been watching this whole MiCA rollout from the sidelines. Malta’s not perfect but they’re the only ones who’ve actually built a working pipeline. I talked to a guy who got approved in 7 months-he had a lawyer who’d worked with the MFSA before. That’s the secret. It’s not about the rules, it’s about knowing who to talk to. The system’s opaque but it’s not broken. Just needs a guide.

gary buena

November 24, 2025 AT 10:51the part about fiau and mfsa sharing data is wild. so if you mess up your kyc once, they know? even if you’re just a small exchange? that’s brutal. i thought crypto was supposed to be private

Kandice Dondona

November 24, 2025 AT 13:23Love that Malta’s actually helping people get it right instead of just punishing them 🙌 I’ve seen too many places shut down startups before they even launch. This feels like a real chance for good projects to thrive. Keep doing the work, MFSA! 💪✨

Drew Monrad

November 25, 2025 AT 02:19Let me get this straight-you’re telling me the only way to be legitimate is to pay $150K, wait a year, and submit a whitepaper written by a corporate lawyer? That’s not regulation. That’s extortion disguised as compliance. Crypto was supposed to break the system, not join the country club.

David Cameron

November 25, 2025 AT 07:04If you need a license to trade crypto, are you still trading crypto-or are you just participating in a regulated financial product? The moment you need government approval to exist in this space, you’ve already lost the ethos. Malta didn’t solve the problem. They institutionalized it.

Katherine Wagner

November 26, 2025 AT 13:53Wait so if I issue a token that’s not an ART or EMT I still need a license? But what if its just a loyalty point system on a blockchain? Is that a utility token? Who decides? This is why people give up before they start

Cody Leach

November 27, 2025 AT 18:57Malta’s system isn’t perfect but it’s the most transparent one out there. I’ve worked with regulators in 5 countries. This is the only one that gives you a checklist and a direct contact. Yeah it’s expensive. But if you’re building something real, you want this kind of credibility. The alternatives are worse.