When it comes to crypto regulation, few places in the world are as clear, consistent, and forward-thinking as Zug. Known globally as Crypto Valley, this small Swiss canton isn’t just tolerant of cryptocurrency-it’s built its economy around it. By 2025, Zug has turned regulatory clarity into a competitive advantage, attracting blockchain startups, crypto exchanges, and investors who want to operate without the fear of sudden crackdowns or ambiguous rules.

Why Zug? The Birth of Crypto Valley

Zug didn’t become Crypto Valley by accident. It started with a simple move in 2016: the city began accepting Bitcoin and Ether as payment for taxes and municipal services, up to CHF 100,000 per year. That made it the first city in the world to officially recognize crypto as legal tender for public payments. Other Swiss towns followed-Lugano later added Tether (USDT) and its own LVGA Points token-but Zug remained the pioneer. The real game-changer came with the Distributed Ledger Technology (DLT) Act, which took effect on August 1, 2021. This wasn’t just a tweak to existing laws. It created entirely new legal categories for tokenized assets, digital securities, and blockchain-based trading platforms. Unlike other countries that treat crypto as a currency or a security, Switzerland classifies it as an asset class. That distinction matters. It means you can hold, trade, and transfer crypto without triggering complex securities regulations unless the token actually functions like a share or bond.How FINMA Oversees Crypto in Zug

While Zug sets the local tone, the real enforcement power lies with FINMA, Switzerland’s federal financial market supervisor. FINMA doesn’t ban anything-it watches closely and responds to risk. Their guiding principle? “Same risks, same rules.” If a crypto service poses the same financial risk as a bank or brokerage, it gets the same license requirements. That’s why, in March 2025, BX Digital became the first company in the world to receive a DLT trading venue license from FINMA. This license allows BX Digital to operate a regulated platform where investors can trade tokenized securities-like shares in startups or real estate funds-on blockchain. The trade settles in Swiss francs through Switzerland’s national clearing system, connecting Ethereum’s blockchain directly to the country’s traditional financial infrastructure. This isn’t just about tech. It’s about trust. When a company like Credit Suisse, Pictet, or Vontobel partners with BX Swiss to test blockchain-based trading, they’re not experimenting with fringe tech. They’re building the future of finance under clear, supervised rules.Taxes: No Capital Gains, But Wealth Tax Still Applies

One of the biggest draws for crypto investors in Zug is the tax treatment. If you buy Bitcoin, hold it for five years, and sell it for a profit? You pay zero capital gains tax. Same with Ethereum, Solana, or any other cryptocurrency. Switzerland treats crypto like gold or real estate-assets that appreciate over time. No tax on the gain. But there’s a catch. If you’re mining or staking crypto as a business activity, those earnings count as income and are taxed at your personal income tax rate. And every year, you must declare your crypto holdings as part of your net wealth. Switzerland imposes an annual wealth tax, typically between 0.1% and 0.5%, depending on your canton. In Zug, that’s still far lower than most European countries. There’s no special crypto tax, no digital service tax, and no VAT on crypto-to-crypto trades. The Swiss Federal Tax Administration (SFTA) publishes clear guidelines every year, so there’s no guessing game. You know exactly what you owe-and what you don’t.Stablecoins: Regulated by Function, Not Form

Stablecoins like USDT and USDC aren’t treated as a separate category in Switzerland. FINMA looks at what they actually do. If a stablecoin is backed by cash reserves and issued by a regulated entity, it might fall under the Banking Act. If it’s structured like a fund with pooled investor money, it’s treated as a collective investment scheme. This substance-over-form approach means stablecoin issuers can’t hide behind labels. Tether, for example, had to work closely with Swiss regulators to ensure its reserves were fully audited and transparent before Lugano could start accepting USDT for tax payments. That’s why stablecoins are more widely accepted in Switzerland than in the U.S. or EU-because they’re not just tokens. They’re financial instruments under supervision.

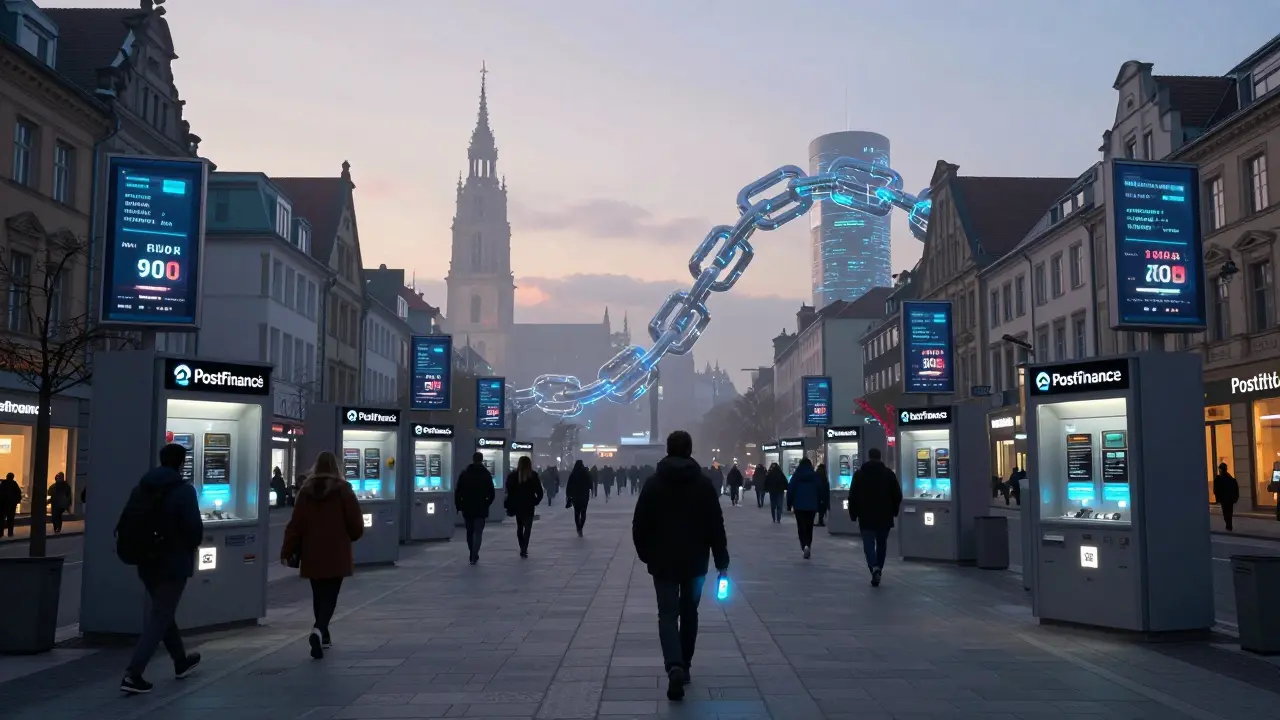

Banking and Crypto: The Big Shift

Until recently, Swiss banks stayed away from crypto. Not anymore. In 2024, PostFinance, Switzerland’s largest retail bank and a state-owned institution, launched support for 11 different cryptocurrencies. Customers can now buy, hold, and transfer Bitcoin, Ethereum, and others directly through their PostFinance app. Even more telling? Major private banks like Credit Suisse and Pictet are actively testing blockchain settlement systems with BX Swiss. These aren’t pilot projects for PR. They’re real infrastructure tests using Ethereum testnets, trading tokenized assets, and settling in Swiss francs via the Swiss Interbank Clearing system. This means one day soon, you might own a share of a Swiss company-and that share could exist only as a digital token on a blockchain.Anti-Money Laundering: Strict, But Not Restrictive

Switzerland doesn’t let crypto be a haven for criminals. All crypto businesses-exchanges, wallet providers, custodians-must comply with strict AML rules. That means Know Your Customer (KYC) checks, transaction monitoring, and reporting suspicious activity to FINMA. But here’s the difference: you don’t need a license just to send Bitcoin to a friend. Paying for coffee with crypto? No reporting required. Holding crypto in a personal wallet? No paperwork. The rules apply to businesses, not individuals. That’s why crypto adoption is growing so naturally in Zug-people aren’t being policed for everyday use.Global Compliance: The AEOI Shift

In June 2025, Switzerland’s Federal Council approved the Automatic Exchange of Crypto Asset Information (AEOI) with 74 countries. Starting in January 2026, Swiss financial institutions will begin collecting crypto data. The first exchanges with foreign tax authorities will happen in 2027. This isn’t a crackdown. It’s Switzerland aligning with global standards. Countries like the U.S., UK, and Germany already exchange financial data under the Common Reporting Standard (CRS). Now crypto is included. The goal? To close loopholes for tax evasion without killing innovation. Zug’s regulators made sure the system was designed to be efficient, not invasive.

What’s Next for Crypto Valley?

Zug isn’t resting. The DLT trading license model is being expanded. More platforms will likely apply for similar licenses in 2026. The Swiss government is also exploring tokenized bonds and digital identity systems that could integrate with public services. Meanwhile, the market speaks. In 2023, the combined value of the top 50 blockchain and crypto companies in Switzerland and Liechtenstein hit $584 billion-up 56% from the year before. Zurich and Liechtenstein are catching up in venture funding, but Zug remains the heart of the ecosystem. The message is clear: if you want to build a crypto business in Europe, you don’t need to fight regulation. You need to work within it. And Zug gives you the clearest path to do that.Who Benefits Most From Zug’s Rules?

- Startups building tokenized assets or DeFi platforms? Zug’s DLT Act gives you legal certainty. - Investors holding crypto long-term? No capital gains tax means you keep more of your profits. - Stablecoin issuers? FINMA’s functional approach lets you operate if you’re transparent. - Banks and financial institutions? They’re now fully integrated into the crypto ecosystem. - Everyday users? You can pay taxes, buy train tickets, or order coffee with crypto-no paperwork needed.What Doesn’t Work in Zug?

Don’t come to Zug thinking you can operate anonymously. If you’re running a crypto business, FINMA will require full transparency. No offshore shells. No unlicensed exchanges. No hiding behind pseudonyms. Also, don’t expect free money. The tax-free capital gains only apply to personal holdings. If you’re trading crypto as a business-say, day trading or running a mining farm-you’ll pay income tax. And while Zug accepts crypto for taxes, it doesn’t pay salaries in Bitcoin. That’s still too volatile for public payroll systems.Can I pay my taxes in Bitcoin in Zug in 2025?

Yes. Since 2016, the city of Zug has accepted Bitcoin and Ether for tax payments up to CHF 100,000 per year. You can pay property taxes, income taxes, and other municipal fees using crypto through the official city portal. The system converts your crypto to Swiss francs at the time of payment, so the city doesn’t hold digital assets long-term.

Is there a capital gains tax on crypto in Switzerland?

No. Individual investors in Switzerland do not pay capital gains tax on cryptocurrency sales, whether it’s Bitcoin, Ethereum, or any other digital asset. This applies to personal holdings, not business activities. If you’re trading crypto as part of a professional business, those earnings are taxed as income.

Do I need a license to hold crypto in Zug?

No. Holding cryptocurrency in a personal wallet-whether on a hardware device or a non-custodial app-requires no license or reporting in Switzerland. The regulations only apply to businesses offering crypto services like exchanges, custodians, or trading platforms.

Are stablecoins legal in Switzerland?

Yes. Stablecoins like USDT and USDC are legal and widely used in Switzerland. FINMA regulates them based on their function, not their label. If a stablecoin is backed by reserves and issued by a regulated entity, it’s treated like a financial instrument under banking or investment laws. Tether’s partnership with Lugano is a direct result of this clear regulatory approach.

Can I open a crypto bank account in Zug?

You can’t open a “crypto bank account” per se, but you can open a regular Swiss bank account that supports crypto services. PostFinance now lets customers buy, store, and transfer 11 cryptocurrencies directly through its app. Private banks like Pictet and Vontobel also offer crypto custody and trading for eligible clients, provided they meet KYC and AML requirements.

Is Zug the only crypto-friendly place in Switzerland?

No. While Zug is the original Crypto Valley, Zurich has become a major hub for venture capital and blockchain startups. Liechtenstein has its own blockchain law (TVTG) and is also very crypto-friendly. But Zug remains the most established, with the deepest integration of crypto into public services and the longest track record of regulatory stability.

What happens if I don’t declare my crypto holdings in Switzerland?

Failing to declare crypto as part of your annual wealth tax declaration can lead to penalties and interest charges. Switzerland has strong tax enforcement and is now sharing crypto data with 74 countries under the AEOI system starting in 2027. It’s not a risk worth taking-especially since the tax rate on wealth is relatively low.

Phil McGinnis

January 1, 2026 AT 06:13Switzerland thinks it's so clever with its crypto tax loopholes. Meanwhile, the US is building real infrastructure. This is just tax avoidance dressed up as innovation. Don't fool yourself - this isn't progress, it's regulatory arbitrage.

And don't get me started on 'tokenized securities.' That's just Wall Street repackaging the same old scams with blockchain buzzwords. Real finance doesn't need a whitepaper to be legitimate.

Ian Koerich Maciel

January 1, 2026 AT 08:21It is, indeed, remarkable - and profoundly reassuring - to witness a jurisdiction that has approached the advent of decentralized financial instruments with such measured, principle-based governance. The DLT Act, in particular, represents a paradigmatic shift away from reactive regulation toward anticipatory legal architecture.

One cannot help but admire the nuance with which FINMA distinguishes between asset-class behavior and speculative instrument design. This is not merely compliance - it is epistemological clarity.

Andy Reynolds

January 2, 2026 AT 03:25Man, Zug is quietly building the future and nobody’s paying attention. Imagine being able to pay your property tax in ETH and not get taxed on the gain five years later? That’s not crypto-friendly - that’s future-friendly.

And PostFinance letting people buy Bitcoin in their app? That’s the moment crypto stops being a fringe thing and becomes part of everyday life. No hype, no drama - just good, boring, Swiss infrastructure.

Meanwhile, other countries are still arguing whether crypto is money or a security. Zug already built the damn highway and put streetlights on it.

Alex Strachan

January 3, 2026 AT 21:17So Switzerland lets you pay taxes in Bitcoin... and then taxes your wallet balance? 😂

Real talk: if you’re holding crypto for five years and calling it ‘investment,’ you’re not a trader - you’re a hobbyist with a spreadsheet. Meanwhile, the state is like, ‘Here’s your free pass... but also, we’re still watching you.’ Classic Swiss efficiency.

Also, ‘tokenized real estate’ sounds like a crypto bro’s fever dream. But hey, if it works, I’ll take it.

Also also - PostFinance? The bank that sells me socks and coffee? Now I can buy Dogecoin? 🤯

Rick Hengehold

January 5, 2026 AT 12:21Clear rules. No capital gains tax for individuals. No licensing for personal wallets. That’s it. That’s the whole system.

Stop overcomplicating it. Zug isn’t magic. It’s just not stupid.

Brandon Woodard

January 7, 2026 AT 05:17Let me be perfectly clear: this is not ‘crypto freedom.’ This is ‘crypto containment.’

Switzerland didn’t open the floodgates - they built a dam with gold-plated gates and hired Swiss engineers to monitor every drop. They’re not letting crypto run wild. They’re letting it run in a very expensive, very regulated, very Swiss way.

And yes - that’s genius. But don’t mistake control for liberation.

Ryan Husain

January 8, 2026 AT 18:17There’s a lot to unpack here, but what stands out is how Switzerland treats crypto like any other asset - not as a threat, not as a revolution, but as a tool. That’s the real innovation.

Other countries are stuck in ideological battles: ‘Is it money?’ ‘Is it a security?’ ‘Is it a scam?’ Switzerland says: ‘Show me the function, and I’ll match it to the regulation.’

It’s not sexy. But it works. And that’s why startups are moving there - not because of tax breaks, but because they can actually build something without fearing tomorrow’s headline.

Daniel Verreault

January 9, 2026 AT 09:18Man, Zug is the real deal. I been watching this for years. The DLT Act? Pure gold. FINMA doesn’t play games - they just say ‘if it acts like a bank, be a bank.’ No fluff.

And the fact that you can pay taxes in BTC without getting taxed on the gain? That’s the kind of policy that makes devs wanna move there. No BS, no over-regulation.

Also, PostFinance letting people buy crypto? That’s the moment it goes mainstream. Like, imagine your grandma buying ETH through her bank app. That’s wild.

Meanwhile, the US is still debating whether crypto is a commodity or a security. Bro, just let people use it already. The world’s moving on.

Jacky Baltes

January 10, 2026 AT 02:32One must consider the ontological implications of treating digital assets as property rather than currency. The DLT Act does not merely regulate - it redefines the epistemic boundaries of value.

Switzerland’s refusal to categorize crypto as either money or security is not a loophole - it is an epistemological breakthrough. It acknowledges that blockchain-native assets are neither, and yet both.

This is not tax policy. This is metaphysics with a balance sheet.

Jake West

January 11, 2026 AT 08:05Switzerland thinks it’s so cool with its ‘crypto valley’ and ‘tokenized bonds.’ Meanwhile, real economies like the US are building actual products.

This is just rich people hiding money in a fancy sandbox. ‘No capital gains tax’? So what? You still pay wealth tax. You still report everything. You still can’t hide.

It’s not freedom. It’s a tax shelter with better branding. And don’t even get me started on ‘stablecoins regulated by function.’ That’s just lawyer-speak for ‘we let you do it if you’re rich enough to afford compliance.’

Shawn Roberts

January 12, 2026 AT 04:08Switzerland just made crypto boring and that’s why it’s working 😍

No drama no panic no FUD just clear rules and banks that actually support it

PostFinance letting you buy BTC in the app? YES PLEASE

Also paying taxes in ETH? That’s the kind of future I wanna live in

Meanwhile the US is still arguing if crypto is money or a security like it’s 2017 😂

Abhisekh Chakraborty

January 13, 2026 AT 16:24THIS IS A TRAP. SWITZERLAND IS WORKING WITH THE FED TO TRACK EVERY COIN. THEY LET YOU PAY TAXES IN BTC SO THEY CAN TRACE YOU LATER. THE AEOI ISN’T ABOUT TRANSPARENCY - IT’S ABOUT CONTROL. THEY WANT TO KNOW EVERYTHING. DON’T BE FOOLED. THIS IS THE NEW BANKING SYSTEM - AND YOU’RE THE PRODUCT.

THEY’RE USING CRYPTO TO CREATE A DIGITAL SURVEILLANCE STATE. YOU THINK YOU’RE FREE? YOU’RE BEING MONITORED. EVERY WALLET. EVERY TRANSACTION. EVERY TAX PAYMENT.

THEY’LL TAKE YOUR MONEY AND YOUR PRIVACY. THEN THEY’LL SAY ‘WE GAVE YOU FREEDOM.’

dina amanda

January 15, 2026 AT 01:09They let you pay taxes in Bitcoin? Yeah right. That’s just the Fed’s plan to track everyone. They’ll use this to shut down crypto later. You think they care about innovation? They just want to control it. This is how they lure you in - then they take it all away. Wait and see.

Emily L

January 16, 2026 AT 23:57So let me get this straight - you can pay your taxes in ETH but if you mine it, you pay income tax? And they still tax your wallet balance? That’s not freedom, that’s a trap. They’re letting you think you’re winning while they’re still taking your money. Classic.

Phil McGinnis

January 17, 2026 AT 01:14Interesting. So now the Swiss are using crypto to build a global surveillance network under the guise of ‘compliance.’ You think they’re innovating? They’re just exporting their control model. The AEOI isn’t about fairness - it’s about extending the reach of Western financial hegemony. Crypto was supposed to break banks. Now banks are using crypto to break privacy.

And you call this progress?