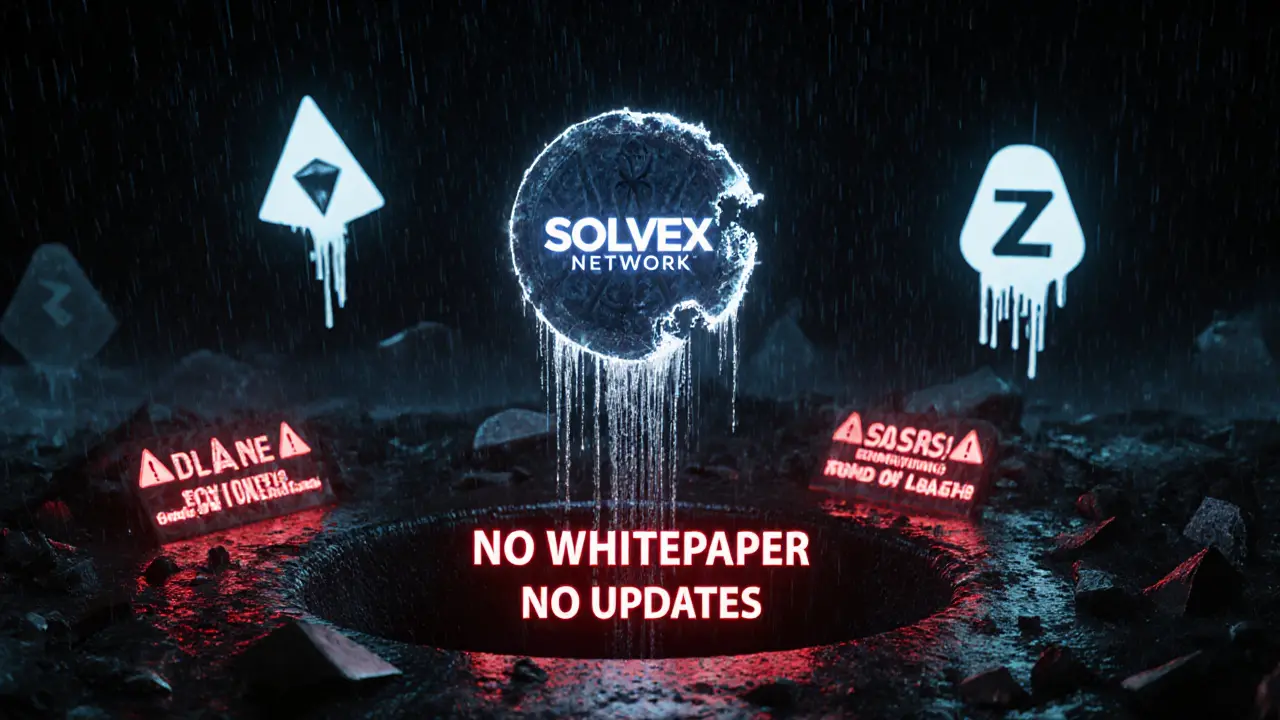

SOLVEX NETWORK (SOLVEX) is a low-volume crypto token with no active development, minimal community, and no major exchange listings. Despite claims of privacy and compliance, it lacks transparency and is widely seen as a high-risk, possibly abandoned project.

SOLVEX price: What it is, where it trades, and why it matters

When you see SOLVEX, a memecoin built on the Solana blockchain with no official team, whitepaper, or roadmap. Also known as SOLVEX token, it’s not a project—it’s a social experiment fueled by Reddit threads, Telegram groups, and speculative trading. Unlike real blockchain projects, SOLVEX doesn’t solve anything. It doesn’t pay dividends, enable smart contracts, or offer DeFi yields. Its only function is to move price based on hype, memes, and whoever’s willing to buy at the top.

It lives on Solana, a high-speed, low-cost blockchain popular for memecoins because it’s cheap to deploy tokens and fast to settle trades. That’s why SOLVEX exists here—not because it’s innovative, but because you can create a token in minutes and list it on a DEX like Raydium or Jupiter without any oversight. Compare that to Ethereum, where even fake coins face scrutiny. On Solana, if you can pay the transaction fee, you can launch a coin. SOLVEX is just one of hundreds that popped up in 2024 and 2025, riding the same wave as DEEPSEEKAI, BIRB, and PRZS.

People chase SOLVEX price because they think they’re getting in early. But here’s the truth: no one owns it. No team is behind it. No audits exist. No liquidity pool is locked. The entire value is based on whether someone else will pay more tomorrow. That’s the same pattern you see with every memecoin that blows up and then crashes—99% of them vanish within months. The ones that stick around? Usually because they got lucky with a celebrity tweet or a viral TikTok trend, not because they had substance.

If you’re looking at SOLVEX price right now, ask yourself: are you trading a coin, or are you betting on a rumor? The data shows most of these tokens have under 100 active holders. Their trading volume dips below $10,000 a day. That’s not a market—it’s a game of musical chairs with crypto wallets. And when the music stops, the last person holding SOLVEX loses everything.

What you’ll find in the posts below are real stories about coins just like SOLVEX—low-liquidity tokens with wild price swings, no real use, and zero long-term future. You’ll see how they’re created, how they get promoted, and why most of them end up worthless. Some are scams. Others are just jokes. But they all teach the same lesson: if there’s no utility, no team, and no transparency, then the only thing driving the price is hope. And hope doesn’t pay bills.