Most people think of Bitcoin or Ethereum when they hear "crypto coin." But what if the next big thing isn’t about faster transactions or cheaper fees-it’s about surviving a future no one can predict? That’s where QANplatform (QANX) comes in. It’s not just another cryptocurrency. It’s built to withstand attacks from quantum computers-machines that don’t even exist yet at full power, but could one day break every crypto security system we have today.

Why Quantum Resistance Matters

Right now, Bitcoin and Ethereum use something called ECDSA for digital signatures. It’s secure against today’s computers. But if a powerful enough quantum computer shows up, it could crack those signatures using Shor’s algorithm. That means anyone with access to such a machine could steal coins from wallets, forge transactions, and break smart contracts. No one knows exactly when this will happen-some say 10 years, others say 20. But QANplatform didn’t wait to find out. Launched in 2021, it was designed from the ground up to be immune to these future threats.Instead of relying on traditional cryptography, QANplatform uses post-quantum algorithms based on lattice mathematics. These are mathematically proven to resist attacks from quantum computers. It’s like building a vault with a lock that even futuristic tech can’t pick. This isn’t theoretical-it’s baked into the core protocol. And unlike Ethereum, which is still planning how to migrate to quantum-safe systems, QANplatform is already there.

What Is QANX, Really?

QANX is the native token of the QANplatform network. It’s not a store of value like Bitcoin, nor is it meant for speculation like many altcoins. QANX is a utility token. You need it to pay for transactions, deploy smart contracts, and run nodes on the network. Think of it like electricity for the blockchain-you can’t use the system without it.As of February 2026, the price of QANX sits at around $0.01565 USD. With a circulating supply of 1.7 billion tokens and a max supply capped at 3.33 billion, inflation is controlled and predictable. Its 24-hour trading volume is modest-around $317,000-meaning it’s still a niche asset. But its market position as the largest player in the quantum-resistant blockchain space gives it a unique role. Out of the $1.2 trillion crypto market, only 0.8% is made up of quantum-resistant projects, and QANplatform holds about 65% of that slice.

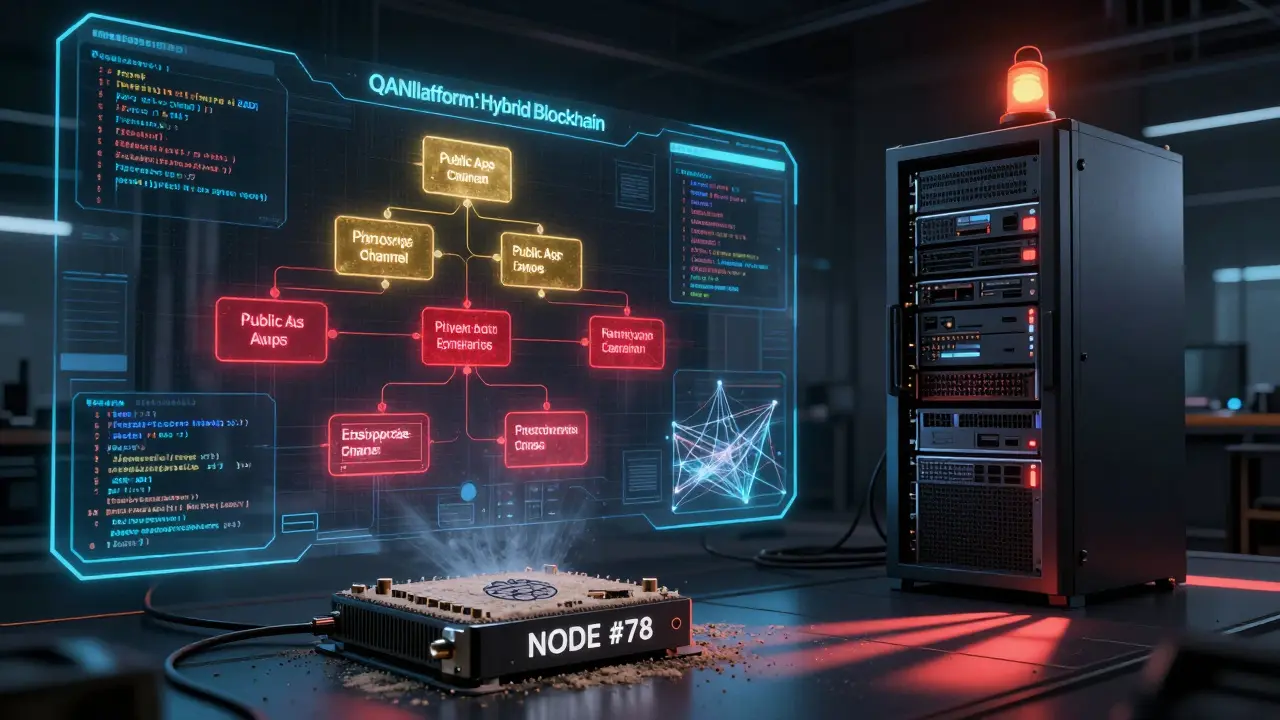

How It Works: Hybrid Blockchain with Low Hardware Needs

Most blockchains force you to choose: public and open, or private and controlled. QANplatform does both. It’s a hybrid layer 1 blockchain, meaning you can run public-facing dApps alongside private enterprise networks-all on the same chain. This is huge for banks, governments, and logistics firms that need transparency for audits but secrecy for sensitive data.And here’s the kicker: you don’t need a supercomputer to run a node. While Ethereum requires 2TB of storage and high-end hardware just to sync a full node, QANplatform can run on a Raspberry Pi or even an old smartphone. You need just 2GB of RAM and 20GB of storage. That’s not a marketing gimmick-it’s documented in their official specs. This makes decentralization far more accessible. Regular people can become validators without buying expensive gear.

The consensus mechanism is called Proof-of-Randomness (PoR). No mining. No energy waste. Validators are chosen randomly based on stake and reputation, not computational power. This cuts energy use by 99.98% compared to Bitcoin’s Proof-of-Work. It’s not just eco-friendly-it’s economically smarter for enterprises trying to reduce operational costs.

Smart Contracts in Java, Python, or Rust-No Solidity Required

One of the biggest roadblocks to blockchain adoption has always been learning curve. Ethereum forces developers to learn Solidity, a language built only for blockchains. If you’re a Java developer at a bank or a Python engineer at a government agency, you’re stuck. You have to retrain.QANplatform changes that. You write smart contracts in languages you already know: Java, Python, or Rust. No new syntax. No weird memory models. Just familiar code compiled directly to run on the blockchain. According to developer surveys from Q4 2025, enterprise teams on QANplatform deploy contracts 80% faster than on Ethereum. One Reddit user, u/BlockchainDev2023, said: “Deployed my first enterprise contract in Java within 3 days-unheard of on Ethereum where I’d need to learn Solidity first.”

This isn’t just convenient. It’s a game-changer for industries that rely on legacy systems and trained engineers. Imagine a logistics company updating its supply chain tracking system without hiring a whole new team of blockchain specialists.

Performance: Fast, Cheap, Predictable

QANplatform isn’t slow just because it’s secure. Independent tests from Q3 2025 show it handles 4,500 transactions per second (TPS) with finality under 3 seconds. That’s 600 times faster than Bitcoin’s 7 TPS and better than Ethereum’s pre-merge speed. Transaction fees? They don’t spike during congestion. You pay a fixed, predictable rate-no surprise costs when the network gets busy.Compare that to Ethereum, where gas fees can jump from $1 to $50 in minutes during NFT drops. For businesses running automated payments or real-time tracking, unpredictability is a dealbreaker. QANplatform removes that risk.

Where It Falls Short

Let’s be honest: QANplatform isn’t perfect. It’s still early. There are only about 120 active developers building on it, compared to Ethereum’s 4,000+. Only 17 exchanges list QANX, and just three major wallets support it. That makes buying, storing, and trading harder than for Bitcoin or Ethereum.There are fewer than 50 live decentralized applications (dApps) on the platform. Most are in enterprise use cases-identity verification, supply chain logs, secure document sharing-not DeFi or NFTs. As of February 2026, DeFi Llama reports that 98% of all locked value in DeFi is on Ethereum and Solana. QANplatform doesn’t even register on that chart.

Some experts question if the whole quantum threat is overblown. Dr. Marcus Chen from Stanford argues that hybrid cryptographic upgrades could protect existing chains without building entirely new ones. And while QANplatform’s security is mathematically sound, it’s untested in the real world. No one has ever launched a quantum computer capable of breaking ECDSA. So is this innovation ahead of its time-or a solution to a problem that doesn’t exist yet?

Who’s Using It?

Despite its small size, adoption is growing in specific sectors. As of Q4 2025, 237 enterprise organizations were actively using QANplatform. The biggest users? European financial institutions (42%), government identity systems (29%), and supply chain management firms (19%).Why? Because these organizations need long-term security. A bank doesn’t want its customer data compromised in 2035 because its blockchain was built in 2024. QANplatform’s quantum resistance isn’t a feature-it’s a compliance requirement.

Regulators are starting to notice too. The European Blockchain Association flagged QANplatform in its February 2026 report for its potential to meet future cybersecurity mandates. Unlike privacy coins like Monero, which face regulatory scrutiny, QANplatform’s transparency and enterprise focus make it harder to target.

What’s Next?

The roadmap is clear. QANplatform 2.0, released in Q3 2025, improved cross-chain bridges and cut finality times to 1.8 seconds. The next big upgrade, called “Quantum Leap,” is scheduled for March 15, 2026. It will introduce formal verification tools-meaning smart contracts can be mathematically proven to work exactly as intended, with zero bugs.By 2027, the team plans to integrate quantum key distribution (QKD) networks, enterprise identity modules, and a dedicated DeFi stack. That last one is critical. Without DeFi, it’s hard to attract retail users. If they succeed, QANX could go from niche enterprise tool to a broader player.

Deloitte’s January 2026 report suggests that if quantum computing advances faster than expected, QANplatform could become essential infrastructure. Gartner predicts 15-20% of Fortune 500 companies will adopt quantum-resistant ledgers by 2028. If that happens, QANX won’t be just another crypto coin-it’ll be a foundational layer for secure digital systems.

Final Thoughts

QANplatform (QANX) isn’t for everyone. If you’re looking to trade crypto for quick gains, it’s not the right choice. Too few exchanges, too few users, too little liquidity.But if you’re in enterprise tech, finance, or government-and you care about long-term data security-then QANplatform might be one of the most important tools you haven’t heard of yet. It’s not trying to beat Ethereum. It’s trying to outlast it. And in a world where digital trust is more fragile than ever, that’s not a bad bet.

Is QANX a good investment?

QANX isn’t designed as an investment asset. It’s a utility token needed to operate the QANplatform network. Its value is tied to enterprise adoption, not speculation. While the price has stayed low ($0.01565 as of Feb 2026), its long-term potential depends on whether quantum computing becomes a real threat before 2035. If it does, demand could surge. If not, adoption may remain limited to niche sectors. Don’t buy it hoping for a 10x return.

Can I mine QANX?

No, you cannot mine QANX. The platform uses Proof-of-Randomness (PoR), not Proof-of-Work. Validators are selected based on stake and reputation, not computational power. You can run a node using low-cost hardware like a Raspberry Pi, but you won’t earn rewards through mining. Instead, you earn QANX by participating in consensus and maintaining network integrity.

How is QANplatform different from Ethereum 2.0?

Ethereum 2.0 improved scalability and energy efficiency but still relies on ECDSA signatures vulnerable to quantum attacks. QANplatform was built from the start with quantum-resistant cryptography. Ethereum plans to migrate later; QANplatform is already secure. Also, Ethereum requires Solidity for smart contracts. QANplatform supports Java, Python, and Rust-languages most enterprise developers already know.

What wallets support QANX?

As of February 2026, only three major wallets fully support QANX: QANwallet (official), Trust Wallet, and Atomic Wallet. Most other wallets don’t list it due to low trading volume and limited demand. If you’re planning to hold QANX, make sure to use one of these three to avoid losing access to your funds.

Is QANplatform safe from hacks?

The protocol’s quantum-resistant encryption is mathematically robust and has been peer-reviewed by cryptographers. However, like any blockchain, smart contracts built on top of it can have bugs. There have been no major protocol-level hacks, but some smart contracts have been exploited due to poor coding-just like on Ethereum. Always audit contracts before using them. The platform’s official documentation and formal verification tools (coming in March 2026) aim to reduce this risk.