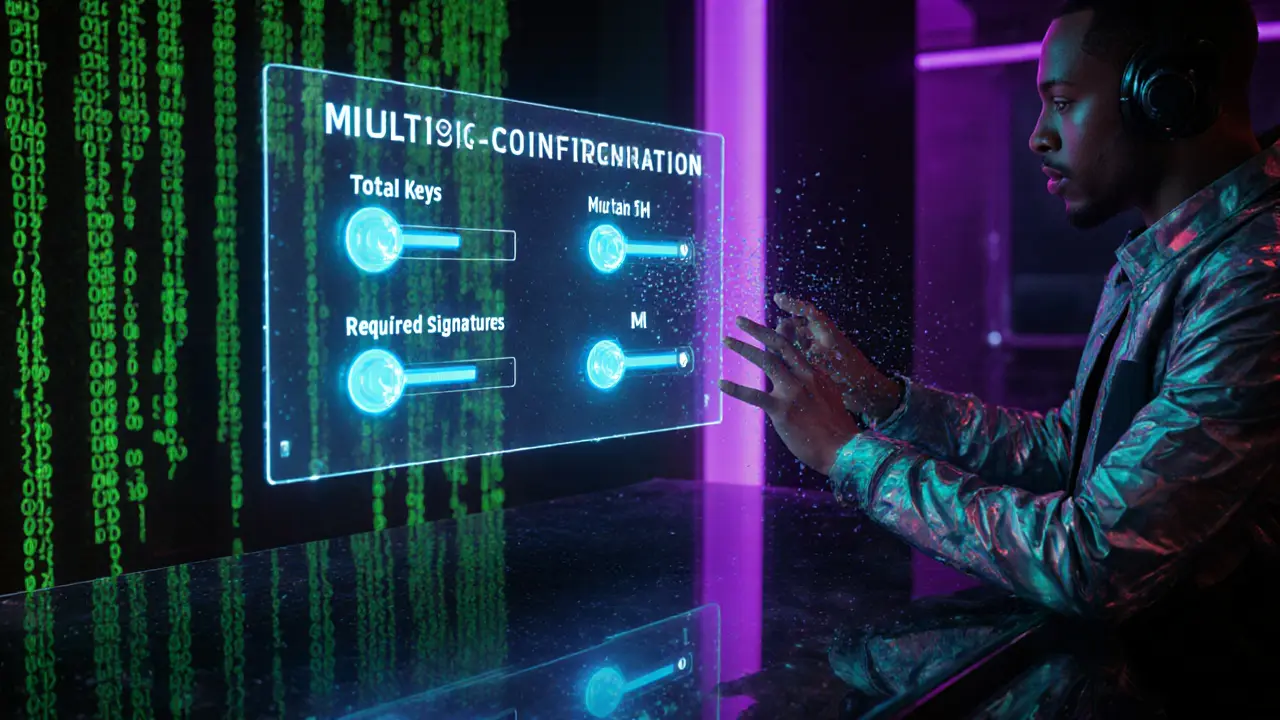

MultiSig Wallet Configuration Simulator

Ever wonder why a single key hack can drain an entire crypto stash in seconds? That nightmare is exactly what multisignature wallets were built to stop. By forcing more than one private key to sign off on a move, they turn a single point of failure into a collaborative checkpoint. Below we’ll break down how the tech works, why it’s safer, and what you need to set one up without getting lost in jargon.

What a MultiSig Wallet Actually Is

MultiSig Wallet is a cryptocurrency wallet that requires multiple private key signatures to authorize a transaction, following an "M-of-N" rule. In plain English, if you set a 2‑of‑3 wallet, any two of the three designated keys must approve before money moves.

This contrasts sharply with a Single‑signature Wallet a wallet that works with just one private key. Lose that key or have it stolen, and the thief walks away with everything.

The magic happens inside a Smart Contract self‑executing code on the blockchain that enforces the multi‑signature rules. The contract holds the funds, records each proposed transaction, and only releases them once the required number of signatures arrives.

How the M‑of‑N System Works

Think of the M‑of‑N model as a digital version of a safe that needs several keys. "M" is the minimum signatures needed, "N" is the total keys you’ve generated. Common setups include:

- 2‑of‑3: Two signatures out of three possible keys. Good for families or small teams.

- 3‑of‑5: Three signatures from five keys. Favoured by larger organisations or DAOs.

When a user initiates a transaction, the Transaction a request to move crypto assets that must be approved by the required number of signers sits in a pending state inside the contract. Each designated signer adds their signature, and once the threshold is met, the contract executes the transfer automatically.

Security Benefits You Can Count On

Here’s why MultiSig wallets are a real security upgrade:

- No single point of failure. Even if one Private Key the secret code that proves ownership of crypto assets gets compromised, the assets stay locked behind the remaining keys.

- Insider‑threat mitigation. A disgruntled employee can’t drain funds alone; they need the agreed‑upon number of co‑signers.

- Phishing resistance. Attackers often target single‑key wallets with fake login pages. With MultiSig, stealing one key isn’t enough.

- Physical theft guard. Lose a hardware device holding one key, and the funds remain safe.

Research from leading security firms shows that MultiSig adoption can cut theft incidents by more than 70% compared to single‑signature setups, especially for high‑value holdings or staking operations.

Popular Configurations and Real‑World Use Cases

Choosing the right M‑of‑N ratio depends on your risk tolerance and workflow.

- 2‑of‑3 - Ideal for personal crypto portfolios shared between a user, a trusted family member, and a hardware device. It balances safety with ease of use.

- 3‑of‑5 - Suited for businesses, DAOs, or protocol developers who need distributed governance. It ensures no single member can unilaterally move funds.

Platforms like Trust Wallet a mobile wallet that combines MultiSig with cold storage and a real‑time security scanner now bundle MultiSig with a Security Scanner an analysis tool that flags risky addresses and smart‑contract interactions. Meanwhile, the Lace Shared Wallet beta lets users set up to three co‑signers directly from the UI, simplifying onboarding for smaller teams.

Side‑by‑Side: Single‑Signature vs MultiSig

| Feature | Single‑Signature Wallet | MultiSig Wallet |

|---|---|---|

| Key requirement | 1 private key | M of N keys (e.g., 2‑of‑3) |

| Risk if key compromised | Full loss of assets | Partial loss; attacker needs >= M keys |

| Operational complexity | Low - only one device | Higher - coordination among signers |

| Best for | Small balances, casual users | Businesses, DAOs, high‑value holdings |

While MultiSig adds steps, the security payoff is huge for anyone serious about protecting crypto assets.

Setting Up Your First MultiSig Wallet

Ready to give it a try? Here’s a practical checklist to avoid common pitfalls:

- Choose hardware wallets for at least two of the keys. Devices like Ledger or Trezor keep keys offline.

- Pick a compatible software wallet. Trust Wallet, Gnosis Safe, or Casa support MultiSig out of the box.

- Generate N keys in separate environments. Never create all keys on the same computer.

- Back up seed phrases on metal plates and store them in different physical locations.

- Define the M‑of‑N policy inside the smart contract. Most platforms let you set this during wallet creation.

- Test with a small amount before moving large balances. Verify that each signer can approve and reject transactions.

- Enable real‑time alerts. If your wallet offers a security scanner, turn on notifications for high‑risk addresses.

Missing any of these steps can expose you to the very vulnerabilities MultiSig is meant to eliminate. For example, storing all keys on the same USB stick defeats the purpose of distributed control.

Common Mistakes and How to Avoid Them

Even seasoned users slip up:

- Over‑complicating the threshold: A 4‑of‑7 setup sounds secure but can stall operations if one signer is unavailable. Pick a threshold that balances safety and usability.

- Neglecting key rotation: Periodically replace keys, especially if a device is lost or suspected of compromise.

- Skipping contract audits: If you deploy a custom MultiSig contract, have it reviewed by security auditors. Flawed code can bypass the M‑of‑N rule.

By staying aware of these issues, you keep the wallet’s security edge sharp.

Future Outlook: Where MultiSig Is Headed

As crypto matures, MultiSig is moving from a niche safety net to a mainstream standard.

- Institutional adoption: Banks and hedge funds are already mandating MultiSig for crypto custody.

- DAO governance: Many decentralized autonomous organizations rely on MultiSig to execute treasury votes, making the governance process tamper‑proof.

- Improved UX: New wallet interfaces aim to hide the complexity behind friendly prompts, lowering the barrier for everyday users.

With ongoing innovations like integrated security scanners and automated recovery mechanisms, the next generation of MultiSig wallets will be both safer and easier to manage.

Key Takeaways

MultiSig wallets turn crypto security from “one key, one risk” into a collaborative defense system. By requiring multiple signatures, they protect against theft, insider threats, phishing, and physical loss. Though they add a bit of operational overhead, the trade‑off is well‑worth it for anyone holding meaningful value.

Frequently Asked Questions

What is the difference between a 2‑of‑3 and a 3‑of‑5 MultiSig wallet?

A 2‑of‑3 wallet needs any two of three keys to approve a transaction, which is faster but slightly less secure than a 3‑of‑5 setup that requires three out of five keys, offering higher redundancy and protection for larger teams.

Can I use a software wallet for all keys in a MultiSig setup?

Technically yes, but it weakens the security model. At least one key should be stored on a hardware wallet or another offline medium to maintain the "cold storage" advantage.

What happens if a signer loses their private key?

If the lost key is part of the required M signatures, you can still move funds as long as the remaining keys meet the threshold. However, you should rotate the lost key by generating a new one and updating the contract to avoid future risks.

Do MultiSig wallets protect against smart‑contract bugs?

They help by requiring multiple eyes on any contract interaction, but the underlying contract code still needs a proper audit. A bug could still be executed if all required signers approve it.

Is MultiSig suitable for everyday small purchases?

For frequent tiny transactions, the extra approval steps can be cumbersome. Many users keep a small single‑signature “spending wallet” for daily use and reserve a MultiSig wallet for larger holdings.

Jason Brittin

June 30, 2025 AT 08:03Nice overview, but honestly, MultiSig is like putting a deadbolt on a bike you only ride once. 😏 Still, for big bags it’s worth the extra steps. Just remember to keep those keys on different devices, or you’re back to square one. 🚀

Carl Robertson

July 8, 2025 AT 10:30Oh, look, another tech‑glossy guide that pretends it’s groundbreaking. The drama of “M‑of‑N” is overhyped, as if anyone actually uses 4‑of‑7 on a Friday night.

Rajini N

July 16, 2025 AT 12:57Setting up a MultiSig wallet doesn’t have to be a black‑box experiment.

First, generate each private key on an isolated, offline machine-never on the same laptop.

Store the seed phrases on metal backups in separate safe locations.

Choose a reputable platform like Gnosis Safe that enforces the M‑of‑N policy at the contract level.

Test the configuration with a tiny amount before committing your main holdings.

Rotate keys periodically; if a device is lost, replace that key and update the contract.

Finally, enable real‑time alerts so you’re instantly aware of any pending approvals.

Amie Wilensky

July 24, 2025 AT 15:23If we consider the essence of security, does the MultiSig paradigm not merely shift the locus of trust from a solitary key to a collective conscience?; Yet, the paradox remains-each additional key introduces a new vector of human error, a fragile bridge over a digital abyss; In this dance of signatures, the user becomes both conductor and audience, forever questioning the true cost of vigilance.

Kate Roberge

August 1, 2025 AT 17:50Most people rave about MultiSig, but the reality is that the added bureaucracy can cripple fast‑moving teams. I’d rather trust a single well‑protected hardware wallet than juggle three signatures that might never sync.

Waynne Kilian

August 9, 2025 AT 20:17i think multiSig can be a good middle ground but dont forget tha t the human factor is the weak link. keep your keys saftey in diffrent places and u wont loose evrything.

Michael Wilkinson

August 17, 2025 AT 22:43If you’re still using a single‑signature wallet for large sums, you’re basically asking for a robbery. Harden your storage now.

april harper

August 26, 2025 AT 01:10The soul of your crypto dies when you ignore multi‑signatures.

Katrinka Scribner

September 3, 2025 AT 03:37I love how MultiSig turns a solo mission into a team effort! 😊 It feels safer when everyone has a say.

VICKIE MALBRUE

September 11, 2025 AT 06:03More signatures, more peace.

Jacob Anderson

September 19, 2025 AT 08:30Sure, because adding more signatures totally eliminates all risk-just like adding more locks guarantees no one will ever pick them.

Kate Nicholls

September 27, 2025 AT 10:57While MultiSig improves security, it also adds latency to transactions, which can be problematic for time‑sensitive trades.

MD Razu

October 5, 2025 AT 13:23When we contemplate the architecture of a MultiSig wallet, we are forced to reckon with the fundamental tension between decentralization and usability.

On one hand, requiring multiple signatures distributes authority, reducing the probability that any single compromised key can orphan the entire fund.

On the other hand, the very act of coordination introduces a social layer that can be fraught with miscommunication and delay.

Consider a scenario where three signers must approve a high‑value transaction and one of them is traveling abroad.

If that signer’s device is offline due to network restrictions, the transaction stalls, potentially costing the organization an opportunity.

Moreover, the storage of multiple private keys across different media expands the attack surface, because each device may have its own vulnerabilities.

A sophisticated adversary could target the weakest of those devices, compromising it and then applying social engineering to coax the others into signing.

Thus, the security model is only as strong as its weakest link, both technical and human.

In practice, many institutions mitigate this by employing hardware security modules that enforce the M‑of‑N rule within a tamper‑proof enclave.

These modules can automate the collection of signatures while preserving the cryptographic guarantees of the contract.

Nevertheless, the deployment of such modules entails significant capital expense and operational overhead.

Organizations must also plan for key rotation, ensuring that compromised or lost keys can be revoked without endangering the remaining assets.

Auditing the smart contract that implements the MultiSig logic is another non‑trivial requirement, as subtle bugs can nullify the signature threshold entirely.

Regular third‑party security assessments become essential to maintain confidence in the system.

In summary, MultiSig offers a powerful tool for risk mitigation, but its efficacy hinges on disciplined operational practices and a clear understanding of the trade‑offs involved.

Charles Banks Jr.

October 13, 2025 AT 15:50Yeah, but if you love paperwork, just add a few more signatures and call it a day. Nothing like bureaucracy to keep the hackers busy!

Billy Krzemien

October 21, 2025 AT 18:17If you’re new to MultiSig, think of it as a digital safety deposit box that requires a small committee to open.

The first step is to choose hardware wallets that you trust, such as Ledger or Trezor, for at least two of the keys.

Next, pick a platform that supports MultiSig natively-Gnosis Safe, Casa, or even the Lace Shared Wallet beta are good options.

Create each private key in a different environment; for example, generate one on your desktop, another on a laptop, and the third on a dedicated Raspberry Pi.

Never store all the seed phrases in the same physical location; use fire‑proof metal wallets and keep them in separate safe deposit boxes.

When you set up the contract, define an M‑of‑N threshold that matches your risk tolerance, such as 2‑of‑3 for personal use or 3‑of‑5 for an organization.

After deployment, perform a dry run by sending a small amount of cryptocurrency and have each signer approve the transaction.

Observe the approval flow; if any signer experiences delays, note the cause and adjust your process accordingly.

Enable real‑time alerts from your wallet provider so you receive push notifications whenever a transaction is pending.

Consider integrating a security scanner that flags high‑risk addresses or suspicious contract interactions before you sign.

If you ever lose a key, initiate a key rotation by generating a new key and updating the MultiSig contract, ensuring the old compromised key is revoked.

Regularly review the contract code and, if possible, have it audited by a reputable security firm to catch any hidden vulnerabilities.

Document your MultiSig governance policy in a shared, version‑controlled repository so all participants understand the rules.

Educate all signers on phishing awareness; even with MultiSig, a malicious actor can trick a signer into approving a harmful transaction.

Finally, balance security with usability; overly complex thresholds can impede legitimate activity and lead users to circumvent the system.

By following these best practices, you’ll enjoy the peace of mind that comes from distributed control without sacrificing day‑to‑day functionality.

Oreoluwa Towoju

October 29, 2025 AT 19:43Great checklist, especially the part about separate environments. Keeping the process simple helps everyone stay on board.

Ben Dwyer

November 6, 2025 AT 22:10Remember, consistency in your signing routine builds trust among the team.

Lindsay Miller

November 15, 2025 AT 00:37It can feel overwhelming at first, but taking it step by step makes it manageable. You’ve got this.

Naomi Snelling

November 23, 2025 AT 03:03Don’t be fooled by the hype; every time a new MultiSig feature rolls out, there’s a hidden backdoor waiting to be exploited. Corporations love the illusion of security while they harvest your signature data. Stay skeptical and keep your keys offline.