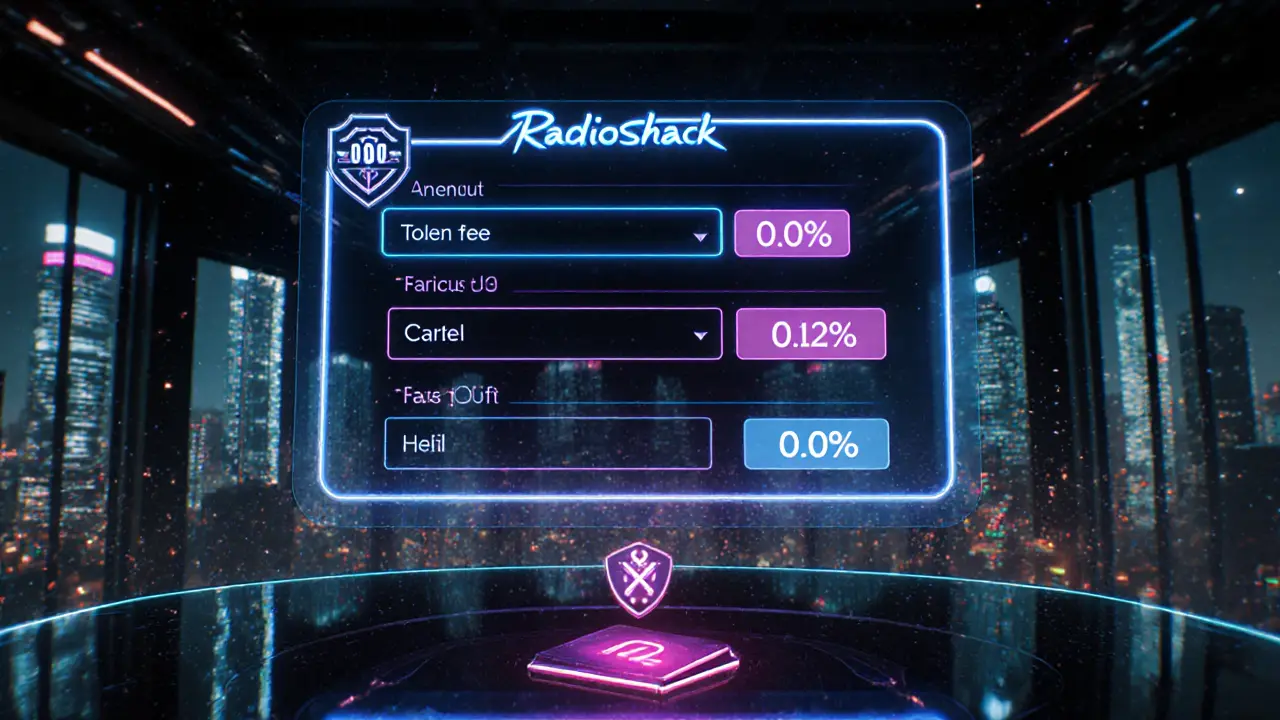

A detailed review of RadioShack on Optimism, covering fees, liquidity, security, UI, and how it compares to Uniswap and SushiSwap on the same Layer‑2.

DeFi on Optimism: What You Need to Know

When exploring DeFi on Optimism, the ecosystem of decentralized finance projects built on the Optimism layer‑2 network, you’re looking at a fast‑moving slice of crypto that blends low fees with Ethereum security. Also known as Optimism DeFi, it lets traders swap, lend, and earn without the usual gas spikes. DeFi on Optimism is gaining traction because it solves the cost‑and‑speed problem that has held many users back.

Core Building Blocks

The first piece of the puzzle is Optimism, an Ethereum‑compatible rollup that processes transactions off‑chain and settles them on the main chain. Optimism requires rollup technology, which batches many transactions together, reducing gas per operation. This layer‑2 solution inherits Ethereum's security while delivering sub‑second finality. Next up is Decentralized Finance (DeFi), a suite of open‑source financial services like lending, trading, and yield farming that runs on smart contracts. DeFi on Optimism encompasses DEXes, lending platforms, and synthetic assets, all benefiting from the network's speed.

Another vital entity is Ethereum, the base blockchain that provides security guarantees for Optimism. Optimism leverages Ethereum's consensus, so any upgrade on Ethereum directly influences Optimism’s security model. Because of this relationship, developers can port existing Ethereum DeFi contracts to Optimism with minimal changes, enabling a smooth migration path.

Layer‑2 scaling itself is a broader concept that ties everything together. L2 solutions like Optimism require bridges, which move assets between Ethereum and the rollup. These bridges are the arteries of the ecosystem; without them, liquidity would stay locked on the main chain. The bridge architecture influences how quickly users can move tokens, impacting the overall user experience.

Current trends show a surge in yield farming opportunities that capitalize on the lower transaction costs. Projects are also experimenting with cross‑chain NFTs that can be minted on Optimism and displayed on other L2s, expanding the use‑case beyond pure finance. These innovations illustrate how DeFi on Optimism expands the traditional definition of decentralized finance.

When you start tracking metrics, total value locked (TVL) and average gas price become the go‑to numbers. TVL signals how much capital trusts the ecosystem, while gas price reflects the cost advantage over Ethereum. Analytics platforms now provide real‑time dashboards for Optimism, letting traders compare performance across different DEXes and lending protocols.

The collection of articles below dives deep into these topics. You'll find an Instant Bitex review that explains why the exchange shut down, a guide to the future of mining pools, and a detailed look at real‑world Sybil attacks that affect DeFi governance. Each piece adds a layer of insight, helping you navigate the fast‑changing world of DeFi on Optimism.

Ready to explore specific projects, security considerations, and strategic tips? Scroll down to see the curated posts that break down everything from swap fees to emerging trends, giving you the tools to make informed decisions in this vibrant L2 DeFi space.