Get the complete rundown on GEO's 2020 GEOCASH airdrop, claim steps, token specs, migration to ODIN Chain, current price, and FAQs for holders.

GEO Token: Overview, Use Cases, and Market Insights

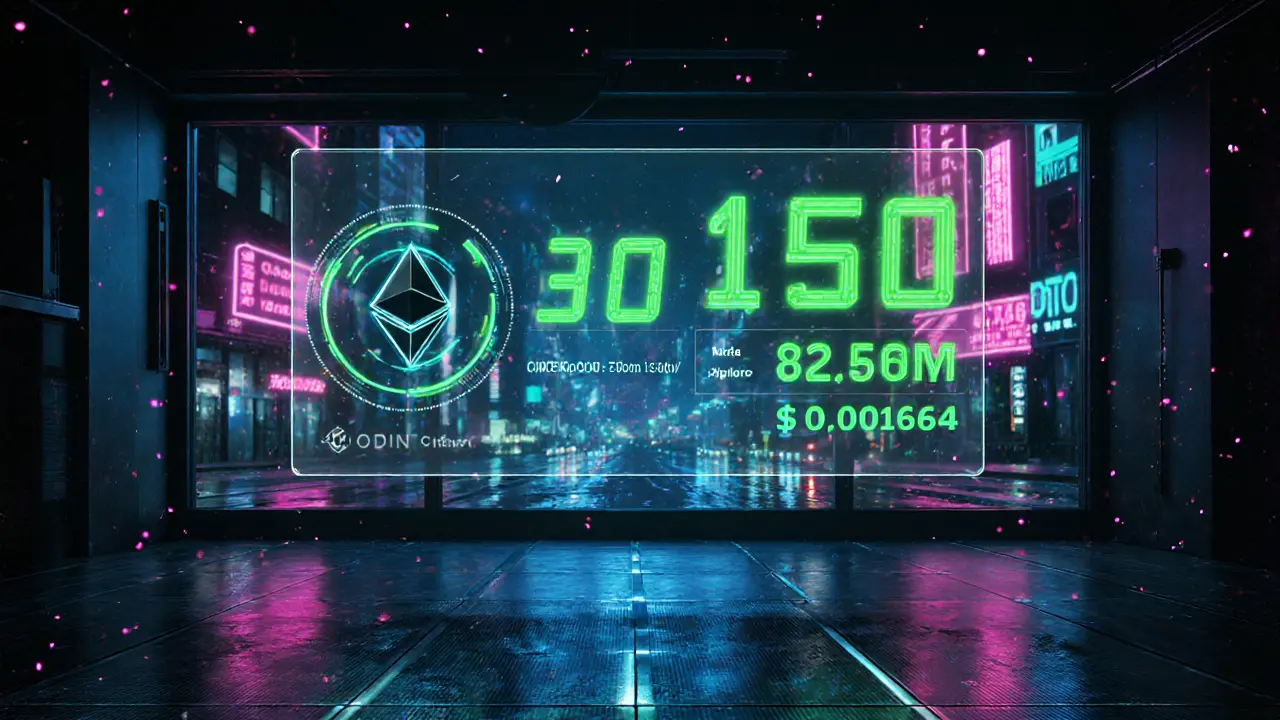

When you hear about GEO token, a utility token built on a public blockchain that fuels the Geo platform. Also known as GEO, it serves as a medium for transaction fees, governance voting, and access to premium data services. GEO token is part of the broader cryptocurrency ecosystem, which includes millions of digital assets that rely on cryptographic security and decentralized networks. Understanding GEO means looking at its tokenomics, the rules that dictate supply, distribution, and incentives. These rules shape the token’s scarcity, reward mechanisms for holders, and the way new tokens are minted or burned. The token operates on a blockchain platform that records every transaction in an immutable ledger, providing transparency and auditability for users and regulators alike. The three key semantic relationships are: GEO token encompasses utility within a blockchain ecosystem; GEO token requires tokenomics to define its economic model; and market intelligence influences GEO token price and adoption.

Why GEO Token Matters for Traders and Developers

For traders, GEO token’s price reacts to on-chain metrics like active address count, transaction volume, and staking participation. Real‑time market intelligence—such as sentiment analysis, macro‑economic trends, and exchange inflows—helps predict short‑term moves and long‑term potential. Developers, on the other hand, leverage GEO’s smart‑contract capabilities to build decentralized applications (dApps) that tap into Geo’s data feeds, creating services ranging from geolocation‑based NFTs to location‑aware DeFi products. The token’s governance model lets holders vote on protocol upgrades, fee adjustments, and new feature rollouts, ensuring the community shapes the roadmap.

Security is another pillar: GEO token inherits the security properties of its underlying blockchain, which uses proof‑of‑stake consensus to lower energy use while maintaining high throughput. Defensive measures like multi‑signature wallets and hardware‑based authentication protect assets against theft. Meanwhile, compliance frameworks are emerging as regulators focus on crypto classification, AML/KYC procedures, and token reporting standards. Staying compliant while maximizing utility is a balancing act that GEO token’s design tries to simplify.

Below you’ll find a curated collection of articles that dive deeper into related topics—exchange reviews, mining pool trends, Sybil attack case studies, DeFi token analyses, airdrop guides, and more. Each piece adds a layer of insight to help you assess GEO token’s place in the larger crypto landscape, whether you’re looking to trade, develop, or simply stay informed. Explore the range of perspectives and practical tips to make smarter decisions around GEO token and its ecosystem.