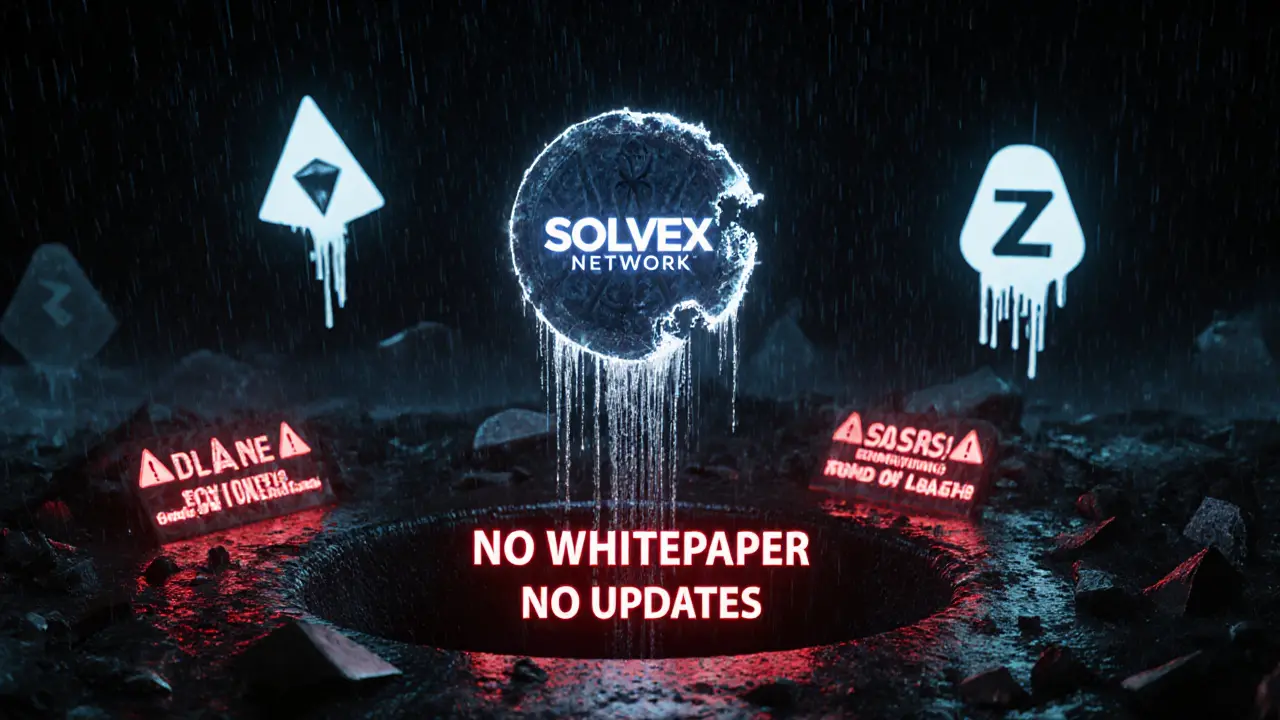

SOLVEX NETWORK (SOLVEX) is a low-volume crypto token with no active development, minimal community, and no major exchange listings. Despite claims of privacy and compliance, it lacks transparency and is widely seen as a high-risk, possibly abandoned project.

SOLVEX coin: What It Is, Why It Matters, and What You Need to Know

When people talk about SOLVEX coin, a speculative memecoin built on the Solana blockchain with no official team, roadmap, or real-world use. Also known as SOLVEX token, it’s one of dozens of low-liquidity tokens that pop up on Solana every week—driven by hype, not fundamentals. Unlike Bitcoin or Ethereum, SOLVEX doesn’t solve a problem, streamline payments, or power a decentralized app. It exists because someone created it, posted it on Twitter, and a few hundred traders bought in hoping for a quick pump.

It’s part of a bigger pattern you’ve probably seen: tokens named after random words, tied to no project, and priced based on memes, not metrics. Solana, a high-speed, low-cost blockchain popular for memecoins due to its fast transactions and cheap fees has become the go-to home for these tokens because it’s easy to launch on. But that ease also means there’s almost no filter—anyone can create a token called SOLVEX and list it on a DEX like Raydium or Jupiter. Then it’s up to the community to decide if it’s worth anything. And most of the time, it’s not.

You’ll find SOLVEX coin mentioned alongside other chaotic tokens like DeepSeek AI Agent (DEEPSEEKAI), a Solana-based coin pretending to be an AI project with zero actual AI, or Birb (BIRB), a meme token that’s actually three different coins on different chains. These aren’t investments—they’re digital lottery tickets. People trade them for fun, for FOMO, or because they think they’re getting in early. But the odds are stacked: low liquidity means big price swings, no audits mean you could get rug-pulled anytime, and zero team means no one’s even pretending to build anything.

So why does SOLVEX coin even exist? Because the crypto market still rewards noise over substance. If you’re looking for real value, you’ll find it in projects with working products, transparent teams, and actual demand. But if you’re here to see how wild the memecoin game has gotten, you’re in the right place. Below, you’ll find real breakdowns of similar tokens—what worked, what failed, and what to watch out for next time someone tells you "this one’s the next big thing."