There is no Hyperion crypto exchange. Scammers are using the name to trick users into depositing funds. Learn what Hyperion.fund, Hyperion Token, and Hyperion Networks actually do - and how to avoid losing money to fake crypto platforms.

Cryptocurrency Market Intelligence Hub

When you dive into cryptocurrency market intelligence, real‑time data and analysis that link crypto assets with traditional markets. Also known as crypto market insight, it helps traders spot trends fast. This hub pulls together every angle you need to make informed moves.

First, blockchain analytics, the process of examining transaction flows, wallet activity, and protocol health provides the backbone for any crypto strategy. Next, on‑chain metrics, indicators like active addresses, hash rate, and gas fees turn raw data into actionable signals. Pair those with technical analysis, chart patterns and indicator readings that forecast price moves, and you have a solid decision‑making framework. Finally, financial news, updates on macro trends, earnings, and regulatory shifts inject real‑world context that can swing markets in seconds.

What You’ll Find Below

In the collection that follows, you’ll see deep‑dive reviews of exchanges, token breakdowns, mining pool outlooks, and security alerts—all built on the pillars of cryptocurrency market intelligence. Whether you’re hunting the next high‑yield token or guarding against a Sybil attack, the articles below give you the data, tools, and perspectives you need to trade with confidence.

Uniswap v3 is the leading decentralized exchange with concentrated liquidity, lower fees on L2s, and deep trading volume. It’s powerful but complex-perfect for experienced users who want full control over their crypto trades.

zk-SNARKs and zk-STARKs are two zero-knowledge proof systems that enable private, scalable blockchain transactions. Learn how they differ in security, cost, speed, and future-proofing to choose the right one for your project.

NDAX is Canada's top crypto exchange for trading Bitcoin, Ethereum, and 37+ other coins directly with Canadian dollars. Low fees, strong security, and 24/7 support make it the best choice for Canadian investors.

Russia doesn't ban all crypto exchanges - it forces them to choose between compliance and closure. Garantex and Grinex were shut down for sanctions evasion, while Binance and Kraken are blocked by infrastructure. Only state-approved platforms survive.

GOBL (GOBL) is a high-risk meme coin with no team, no utility, and near-zero liquidity. Learn its price, where to buy it, why experts warn against it, and whether it's worth your money in 2026.

WingRiders is Cardano's leading decentralized exchange with stablecoin swaps, multi-reward farming, and DAO governance. Learn how it works, its WRT token, and why it's still the best DeFi option on Cardano in 2026.

Learn how to protect your crypto from phishing in 2026 with proven steps: hardware wallets, seed phrase safety, MFA, password managers, and training your brain to spot scams before it's too late.

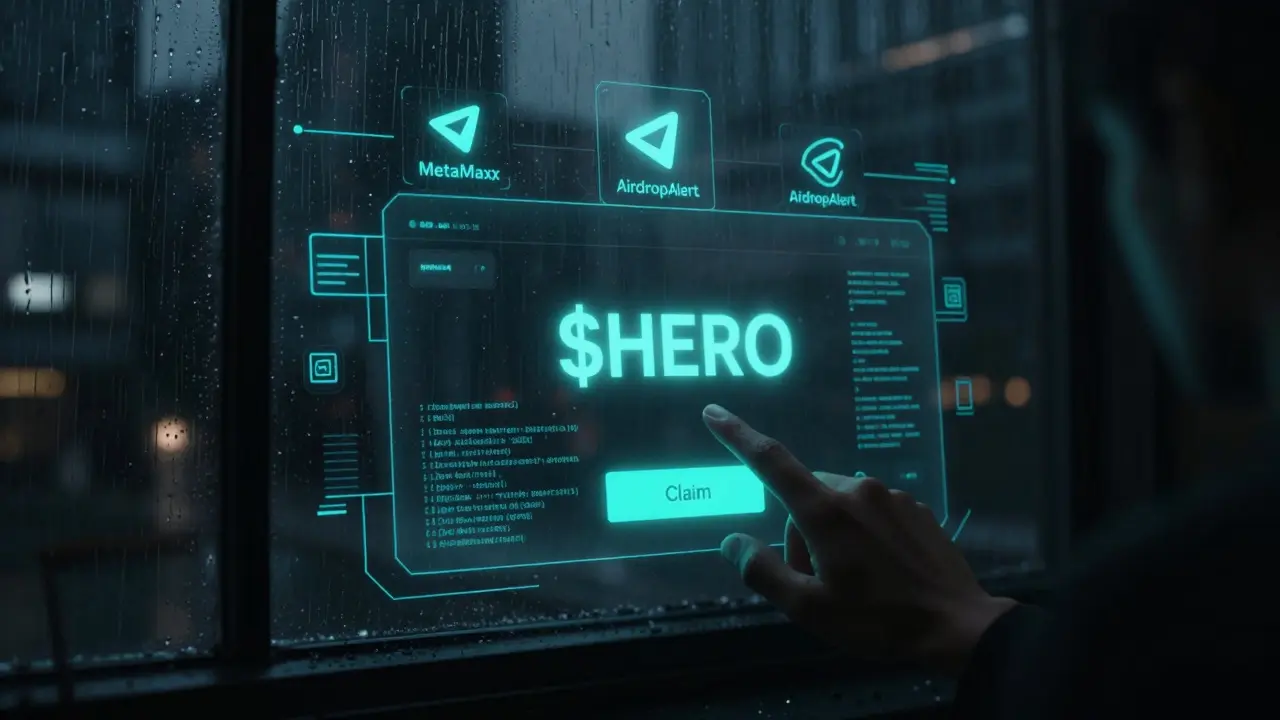

The Step Hero airdrop offers $HERO tokens with a $4,800 prize pool, but official details are scarce. Learn how to check eligibility, avoid scams, and safely participate in this quiet but active 2026 crypto airdrop.

Digitex offers zero-fee crypto trading but has low liquidity, slow withdrawals, and a risky token-based model. Learn why this exchange may not be worth the risk in 2026.

Form 8949 is required for every crypto sale, trade, or disposal in 2025. Learn what transactions to report, how to calculate gains, and why wallet-by-wallet accounting now matters. IRS penalties are real - don’t risk them.

GameZone (GZONE) didn't run a traditional airdrop - but its staking system pays holders weekly through token burns and rewards. Learn how to access IGOs, earn passive income, and build your tier in the blockchain gaming ecosystem.